2022 Investment Climate Statements: Armenia

Executive Summary

Over the past several years, Armenia has received consistently respectable rankings in international indices that review country business environments and investment climates. Projects representing significant U.S. investment are present in Armenia, most notably ContourGlobal’s Vorotan Hydroelectric Cascade and Lydian’s efforts to develop a major gold mine. U.S. investors in the banking, energy, pharmaceutical, information technology, and mining sectors, among others, have entered or acquired assets in Armenia. Armenia presents a variety of opportunities for investors, and the country’s legal framework and government policy aim to attract investment, but the investment climate is not without challenges. Obstacles include Armenia’s small market size, relative geographic isolation due to closed borders with Turkey and Azerbaijan, weaknesses in the rule of law and judiciary, and a legacy of corruption. Net foreign direct investment inflows are low. Armenia had commenced a robust recovery from a deep 2020 recession prior to the introduction of new sanctions against Russia. GDP growth reached five percent in 2021 and had been expected to continue to grow in 2022 by at least five percent. As a result of the war and sanctions imposed on Russia, Armenia’s 2022 GDP growth forecast is now just above one percent.

In May 2015, Armenia signed a Trade and Investment Framework Agreement with the United States. This agreement established a United States-Armenia Council on Trade and Investment to discuss bilateral trade and investment and related issues. Since 2015, Armenia has been a member of the Eurasian Economic Union, a customs union that brings Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia into a single integrated market. In November 2017, Armenia signed a Comprehensive and Enhanced Partnership Agreement with the European Union, which aimed in part to improve Armenia’s investment climate and business environment.

Armenia imposes few restrictions on foreign control and rights to private ownership and establishment. There are no restrictions on the rights of foreign nationals to acquire, establish, or dispose of business interests in Armenia. Business registration procedures are generally straightforward. According to foreign companies, otherwise sound regulations, policies, and laws are sometimes undermined by problems such as the lack of independence, capacity, or professionalism in key institutions, most critically the judiciary. Armenia does not limit the conversion and transfer of money or the repatriation of capital and earnings. The banking system in Armenia is sound and well-regulated, but investors note that the financial sector is not highly developed. The U.S.-Armenia Bilateral Investment Treaty provides U.S. investors with a variety of protections. Although Armenian legislation offers protection for intellectual property rights, enforcement efforts and recourse through the courts are in need of improvement.

Armenia experienced a dramatic change of government in 2018, when a democratically elected leader came to power on an anti-corruption platform after street protests toppled the old regime. Following the 2020 NK hostilities, in June 2021, the incumbent retained power in snap parliamentary election that met most international democracy standards. The government continues to push forth with economic and anti-corruption reforms that have improved the business climate. Overall, the competitive environment in Armenia is improving, but several businesses have reported that broader reforms across judicial, tax, customs, health, education, military, and law enforcement institutions will be necessary to shore up these gains.

Despite improvements in some areas that raise Armenia’s attractiveness as an investment destination, investors claim that numerous issues remain and must be addressed to ensure a transparent, fair, and predictable business climate. A number of investors have raised concerns about the quality of dialogue between the private sector and government. Investors have also flagged issues regarding government officials’ ability to resolve problems they face in an expeditious manner. An investment dispute in the country’s mining sector has attracted significant international attention and remains outstanding after several years.

1. Openness To, and Restrictions Upon, Foreign Investment

POLICIES TOWARDS FOREIGN DIRECT INVESTMENT

The government of Armenia officially welcomes foreign investment. The Ministry of Economy is the main government body responsible for the development of investment policy in Armenia. Armenia has achieved respectable rankings on some global indices measuring the country’s business climate. Armenia’s investment and trade policy is relatively open; foreign companies are entitled by law to the same treatment as Armenian companies. Armenia has strong human capital and a well-educated population, particularly in the science, technology, engineering, and mathematics fields, leading to significant investment in the high-tech and information technology sectors. Many international companies have established branches or subsidiaries in Armenia to take advantage of the country’s pool of qualified specialists and position within the Eurasian Economic Union (EAEU). However, many businesses have identified challenges with Armenia’s investment climate in terms of the country’s small market (with a population of less than three million), limited consumer buying power, relative geographic isolation due to closed borders with Turkey and Azerbaijan, and concerns related to weaknesses in the rule of law.

Following a peaceful revolution in 2018 fueled in large measure by popular frustration with endemic corruption, Armenia’s government launched a high-profile anti-corruption campaign. The fight against corruption needs to be institutionalized in the long term, especially in critical areas such as the judiciary, tax and customs operations, and health, education, military, and law enforcement sectors. Foreign investors remain concerned about the rule of law, equal treatment, and ethical conduct by government officials. U.S companies have reported that the investment climate is tainted by a failure to enforce intellectual property rights. There have been concerns regarding the lack of an independent and strong judiciary, which undermines the government’s assurances of equal treatment and transparency and reduces access to effective recourse in instances of investment or commercial disputes. Representatives of U.S. entities have raised concerns about the quality of stakeholder consultation by the government with the private sector and government responsiveness in addressing concerns among the business community.

Government officials have publicly responded to private sector concerns about perceptions of slow movement in the government bureaucracy as a function of needing to guard against corruption-related risks. The Armenian National Interests Fund and Investment Support Center (Enterprise Armenia) are responsible for attracting and facilitating foreign direct investment.

LIMITS ON FOREIGN CONTROL AND RIGHT TO PRIVATE OWNERSHIP AND ESTABLISHMENT

There are generally very few restrictions on foreign ownership or control of commercial enterprises. There are some restrictions on foreign ownership within the media and commercial aviation sectors. Local incorporation is required to obtain a license for the provision of auditing services.

The Armenian government does not maintain investment screening mechanisms in general, and for foreign direct investment, in particular. Government approval is required to take advantage of certain tax and customs privileges, and foreign investors are subject to the same requirements as domestic investors where regulatory approvals may be involved.

OTHER INVESTMENT POLICY REVIEWS

An Armenian ecological NGO recently published an article claiming that many mines in Armenia do not have corporate social responsibility obligations, which are required by law. However, it was unclear from the article if the mines in question were still actively operating.

In 2019, the U.N. Conference on Trade and Development (UNCTAD) published its first investment policy review for Armenia. The World Trade Organization (WTO) published a Trade Policy Review for Armenia in 2018.

BUSINESS FACILITATION

Companies can register electronically here. This single window service was launched in 2011 and allows individual entrepreneurs and companies to complete name reservation, business registration, and tax identification processes all at once. The application can be completed in one day. An electronic signature is needed in order to be able to register online. Foreign citizens can obtain an e-signature and more detailed information from the e-signature portal. In 2019, the government launched an e-regulations platform that provides a step-by-step guide for business and investment procedures. The platform is available at https://armenia.eregulations.org/ . According to the latest estimates, it takes four days to complete the company registration process in Armenia.

OUTWARD INVESTMENT

The Armenian government does not restrict domestic investors from investing abroad.

2. Bilateral Investment and Taxation Treaties

Basic provisions covering U.S. investment in Armenia are set by the U.S.-Armenia Bilateral Investment Treaty (BIT), in force since 1996. The U.S.-Armenia BIT stipulates that conditions for investors of each party be no less favorable than for the party’s own national investors or for investors from any third state. It provides for the option of international arbitration in the case of investment disputes. Armenia has BITs in force with 39 countries. The full list is available at https://investmentpolicy.unctad.org/international-investment-agreements/countries/9/armenia. Armenia is signatory to the Commonwealth of Independent States Multilateral Convention on the Protection of Investor Rights, in addition to some other international agreements with investment provisions.

Armenia became a member of the EAEU in January 2015, together with Belarus, Kazakhstan, Kyrgyzstan, and Russia. Armenia entered into a Comprehensive and Enhanced Partnership Agreement (CEPA) with the European Union (EU) in November 2017. CEPA entered into full force on March 1, 2021. While CEPA does not affect customs or tax rates, it will, over time, align Armenia’s regulatory system and standards with those of the EU as much as possible within the context of Armenia’s EAEU obligations.

There is no free trade agreement between the United States and Armenia. In May 2015, Armenia signed a Trade and Investment Framework Agreement (TIFA) with the United States. The TIFA establishes a U.S.-Armenia Council on Trade and Investment to discuss bilateral trade, investment, and related issues and examine ways to strengthen the trade and investment relationship between the two countries.

Armenia does not issue foreign tax credits and does not recognize the existing double taxation treaty signed by the Union of Soviet Socialist Republics (USSR) and the United States that entered into force in 1976. The United States considers Armenia to be party to this treaty by virtue of state succession to treaties and Armenia’s declaration of its commitment to fulfill the international treaty obligations of the former USSR as expressed in the Alma Ata Declaration of 1991. Armenia has double taxation treaties with several dozen other countries. The United States and Armenia signed the Foreign Account Tax Compliance Agreement (FATCA), which entered into force in July 2019. Armenia is a member of the OECD Inclusive Framework on Base Erosion and Profit Shifting and is a party to the Inclusive Framework’s October 2021 deal on the two-pillar solution to global tax challenges, including a global minimum corporate tax.

3. Legal Regime

TRANSPARENCY OF THE REGULATORY SYSTEM

The Armenian government increasingly makes efforts to uses transparent policies and laws to foster competition. Some contacts have reported that over the last few years the Armenian government has pursued a more consistent execution of these laws and policies in an effort to improve market competition and remove informal barriers to market entry, especially for small- and medium-sized enterprises. Armenia’s legislation on the protection of competition has been improved with clarifications regarding key concepts. There have been some procedural improvements for delivering conclusions and notifications of potential anti-competitive behavior via electronic means. However, companies regard the efforts of the State Commission for the Protection of Economic Competition (SCPEC) alone as insufficient to ensure a level playing field. They indicate that improvements in other state institutions and authorities that support competition, like the courts, tax and customs, public procurement, and law enforcement, are necessary. Numerous studies observe a continuing lack of contestability in local markets, many of which are dominated by a few incumbents. Banking supervision is relatively well developed and largely consistent with the Basel Core Principles. The Central Bank of Armenia (CBA) is the primary regulator of the financial sector and exercises oversight over banking, securities, insurance, and pensions. Armenia has adopted IFRS as the accounting standard for enterprises. Data on Armenia’s public finances and debt obligations are broadly transparent, and the Ministry of Finance publishes periodic reports that are available online.

Safety and health requirements, many of them holdovers from the Soviet period, generally do not impede investment activities. Nevertheless, investors consider bureaucratic procedures to be sometimes burdensome, and discretionary decisions by individual officials may present opportunities for petty corruption. A unified online platform for publishing draft legislation was launched in March 2017. Proposed legislation is available for the public to view. Registered users can submit feedback and see a summary of comments on draft legislation. However, the time period devoted to public comments is often regarded as insufficient to solicit substantive feedback. The results of consultations have not been reported by the government in the past. The government maintains other portals, including http://www.e-gov.am and http://www.arlis.am, that make legislation and regulations available to the public. The governmental https://www.aipa.am/en/ portal is a comprehensive platform for a range of services including registering intellectual property, opening a company, or applying for a construction permit. It also provides links to key regulatory institutions and laws and regulations. The government does not require environmental and social disclosures to help investors and consumers distinguish between high- and low-quality investments. Some regulations that affect Armenia are developed within the Eurasian Economic Commission, the executive body for the EAEU.

INTERNATIONAL REGULATORY CONSIDERATIONS

Armenia is a member of the EAEU and adheres to relevant technical regulations. Armenia’s entry into CEPA will lead it to pursue harmonization efforts with the EU on a range of laws, regulations, and policies relevant to economic affairs. Armenia is also a member of the WTO, and the Armenian government notifies draft technical regulations to the WTO Committee on Technical Barriers to Trade. Armenia is a signatory to the Trade Facilitation Agreement and has already sent category “A”, “B,” and “C” notifications to the WTO.

LEGAL SYSTEM AND JUDICIAL INDEPENDENCE

Armenia has a hybrid legal system that includes elements of both civil and common law. Although Armenia is developing an international commercial code, the laws regarding commercial and contractual matters are currently set forth in the civil code. Thus, because Armenia lacks a commercial court, all disputes involving contracts, ownership of property, or other commercial matters are resolved by litigants in courts of general jurisdiction, which handle both civil and criminal cases. Judges that handle civil matters may be overwhelmed by the volume of cases before them and are frequently seen by the public as corrupt. Despite the ability of courts to use the precedential authority of the Court of Cassation and the European Court of Human Rights, many judges who specialize in civil cases do not do so, increasing the unpredictability of court decisions in the eyes of investors.

Businesses tend to perceive that many Armenian courts suffer from low levels of efficiency, independence, and professionalism, which drives a need to strengthen the judiciary. Very often in proceedings when additional forensic expertise is requested, the court may suspend a case until the forensic opinion is received, a process that can take several months. Businesses have noted that many judges at courts of general jurisdiction may be reluctant to make decisions without getting advice from higher court judges. Thus, the public opinion is that decisions may be influenced by factors other than the law and merits of individual cases. In general, the government honors judgments from both arbitration proceedings and Armenian national courts.

Due to the nature and complexity of commercial and contractual issues and the caseload of judges who specialize in civil cases, many matters involving investment or commercial disputes take months or years to work their way through the courts. In addition, businesses have complained of the inefficiencies and institutional corruption of the courts. Even though the Armenian constitution provides investors the tools to enforce awards and their property rights, investors claim that there is little predictability in what a court may do.

LAWS AND REGULATIONS ON FOREIGN DIRECT INVESTMENT

Basic legal provisions covering foreign investment are specified in the 1994 Law on Foreign Investment. Foreign companies are entitled by law to the same treatment as Armenian companies. A Law on Public-Private Partnership (PPP), adopted in 2019, establishes a framework for the government to attract investment for projects focused on infrastructure. In 2021, the Law on PPP has been amended to introduce clear criteria for PPP project selection by the Government, as well as enabled investors to apply to the government with PPP project proposals.

The Investment Support Center (Enterprise Armenia) is Armenia’s national authority for investment and export promotion. It provides information to foreign investors on Armenia’s business climate, investment opportunities, and legislation; supports investor visits; and serves as a liaison for government institutions. More information is available via the Investment Support Center’s website.

COMPETITION AND ANTITRUST LAWS

SCPEC reviews transactions for competition-related concerns. Relevant laws, regulations, commission decisions, and more information can be found on SCPEC’s website. Concentrations, including mergers, acquisitions of shares or assets, amalgamations, and incorporations, are subject to ex ante control by SCPEC in accordance with the law. Whenever a concentration gives rise to concerns about harm to competition, including the creation or strengthening of a dominant position, SCPEC can prohibit such a transaction or impose certain remedies. Armenia’s Law on Protection of Economic Competition has been amended several times in recent years to bring Armenia’s competition framework into alignment with EAEU and CEPA requirements. The law was changed in 2020 to improve SCPEC’s capabilities to investigate anti-competitive behavior, in collaboration with Armenia’s investigative bodies, whereas before SCPEC had to rely primarily on document studies and request information from other state bodies.

Amendments to the competition law made in 2021 strengthened SCPEC’s preventive measures by allowing private sector representatives to obtain SCPEC’s advisory opinion on market concentration risks prior to a planned transaction or activity (formerly available only to state bodies). The most recent changes to competition law also defined the order to conduct sectoral market studies to identify potential competition violations and enlarged the scope of market transactions that can be assessed as market concentrations.

EXPROPRIATION AND COMPENSATION

Under Armenian law, foreign investment cannot be confiscated or expropriated except in extreme cases of natural or state emergency upon obtaining an order from a domestic court. According to the Armenian constitution, equivalent compensation is owed prior to expropriation.

DISPUTE SETTLEMENT

ICSID Convention and New York Convention

Armenia is party to the ICSID Convention (Washington Convention) and Convention on the Recognition and Enforcement of Foreign Arbitral Awards (New York Convention).

Under Article 5 of the Armenian Constitution, international treaties ratified by Armenia take precedence over domestic law.

Investor-State Dispute Settlement

According to the Law on Foreign Investment, all disputes that arise between a foreign investor and Armenia must be settled in Armenian courts. A Law on Commercial Arbitration, enacted in 2007, provides a wider range of options for resolving commercial disputes. The U.S.-Armenia BIT provides that in the event of a dispute involving a U.S. investor and the state, the investor may take the case to international arbitration. As of March 2022, two investment disputes brought against Armenia under the U.S.-Armenia BIT were pending with the International Center for Settlement of Investment Disputes.

International Commercial Arbitration and Foreign Courts

Commercial disputes may be brought before an Armenian or any other competent court, as provided by law or in accordance with party agreements. Commercial disputes are heard in courts of general jurisdiction. Specialized administrative courts adjudicate cases brought against state entities. Decisions of general jurisdiction and administrative courts may be appealed first to the Civil Court of Appeal and Administrative Court of Appeal, then to the Civil and Administrative Chamber of the Court of Cassation.

The Law on Arbitration Courts and Arbitration Procedures provides rules governing the settlement of disputes by arbitration. In accordance with the New York Convention and Article 5 of the Armenian Constitution, domestic courts must recognize foreign arbitral awards in cases of conflict between national laws and international treaties ratified by Armenia. Armenia intends to develop an alternative dispute resolution (ADR) mechanism that will include mediation and arbitration. ADR could be used not only in commercial matters, including those involving mobile property and secured transactions, but also in cases involving family and labor disputes. While ADR options are available to those who seek alternatives to litigation, they currently are not widely used or trusted.

BANKRUPTCY REGULATIONS

According to the Law on Bankruptcy adopted in 2006, creditors and equity and contract holders (including foreign entities) have the right to participate and defend their interests in bankruptcy cases. Armenia decided with the passage of a new Judicial Code in 2018 to adopt a new, specialized bankruptcy court, which began operations in 2019. Creditors have the right to access all materials relevant to cases, submit claims to court, participate in meetings of creditors, and nominate candidates to administer cases. Monetary judgments are usually made in local currency. The Armenian Criminal Code defines penalties for false and deliberate bankruptcy, concealment of property or other assets of the bankrupt party, or other illegal activities during the bankruptcy process. UNCTAD observes that Armenia’s framework for bankruptcy procedures needs improvement, adding that insolvency cases are expensive and almost always result in liquidation. Armenia amended its bankruptcy law in December 2019 to reduce the cost of bankruptcy proceedings. In addition, premiums have been set for bankruptcy managers for submitting financial recovery plans, as well as for the recovery of a bankrupt person, with the aim of raising rates of financial recovery. In 2020, the debt threshold to launch bankruptcy proceedings was raised to grant companies a greater ability to pay off debts rather than having their assets frozen.

4. Industrial Policies

INVESTMENT INCENTIVES

Armenia offers incentives for exporters (e.g., no export duty, VAT refund on goods and services exported) and foreign investors (e.g., income tax holidays, the ability to carry forward losses indefinitely, VAT deferral, and exemptions from customs duties for investment projects). Starting in 2018, the Armenian government began exempting imports of capital investment-related goods from VAT payments at the border. In 2015, the Armenian government began exempting from customs duties investment-related imports of equipment and raw materials from non-EAEU member countries.

VAT and customs duties exemptions are implemented by government decisions made on a case-by-case basis. Also, in accordance with the Law on Foreign Investment, several ad hoc incentives may be negotiated on a case-by-case basis for investments that are targeted at certain sectors of the economy or are of strategic interest. As part of its response to COVID-19, the government launched several economic response and social support measures in 2020, some of them, including several support programs in the agriculture sector, are still active in 2022. In May 2022, the government had initiated changes in energy regulations to allow multiple usage points for solar panel installations. The Law on Licensing was amended in 2021 to simplify the licensing requirements for foreign companies to engage in 13 types of business activities in Armenia, including security/encashment and postal services, railroad and taxi services, urban development and engineering, and technical supervision of construction.

FOREIGN TRADE ZONES/FREE PORTS/TRADE FACILITATION

In 2011, Armenia adopted a Law on Free Economic Zones (FEZ), amended in 2018, and developed several key regulations to attract foreign investments into FEZs: exemptions from VAT, profit tax, customs duties, and property tax. The Alliance FEZ was opened in 2013 to focus on high-tech industries, including information and communication technologies, electronics, pharmaceuticals and biotechnology, architecture and engineering, industrial design, and alternative energy. In 2014, the government expanded operations in the Alliance FEZ to include industrial production. In 2015, the Meridian FEZ, focused on jewelry production, watchmaking, and diamond cutting, opened in Yerevan. The Meghri FEZ, located on Armenia’s border with Iran, opened in 2017. A new FEZ, located in Hrazdan, opened in late 2018 and is focused on the high-tech and information technology sectors. Armenia has signaled an interest in developing logistics hubs, including one in Gyumri, to facilitate goods trade.

PERFORMANCE AND DATA LOCALIZATION REQUIREMENTS

There are no performance requirements for investment in terms of mandating local employment. The processes for obtaining visas, residence, or work permits are straightforward. There are no government-imposed conditions on permission to invest.

Armenia does not follow any policy that would force foreign investors to use domestic content in goods and technology. There are no requirements for foreign information technology providers to turn over source code or provide keys for encryption. There are no requirements to store data within the country.

5. Protection of Property Rights

REAL PROPERTY

Armenian law protects secured interests in property, both personal and real. Armenian law provides a basic framework for secured lending, collateral, and pledges and provides a mechanism to support modern lending practices and title registration. According to Armenia’s constitution, foreign citizens are prohibited from owning land, though they may take out long-term leases.

INTELLECTUAL PROPERTY RIGHTS

For additional information about national laws and points of contact at local IP offices, please see WIPO’s country profiles at http://www.wipo.int/directory/en/.

Armenia has a strong legislative and regulatory framework to protect intellectual property rights (IPR). Domestic legislation, including the 2006 Law on Copyright and Related Rights, provides for the protection of copyright with respect to literary, scientific, and artistic works (including computer programs and databases), patents and other rights of invention, industrial design, know-how, trade secrets, trademarks, and service marks. The Intellectual Property Agency (IPA) in the Ministry of Economy is responsible for granting patents and overseeing other IPR-related matters. The collective management organization ARMAUTHOR manages authors’ economic rights.

Trademarks and patents require state registration by the IPA, but copyright does not. There is no special trade secret law in Armenia, but the protection of trade secrets is covered by Armenia’s Civil Code. Formal registration is straightforward, the database of registered IPR is public, and applications to register IPR are published online for two months for comment by third parties. Armenia’s legislation has been harmonized with the World Trade Organization’s Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). In 2005, Armenia created an IPR Enforcement Unit in the Organized Crime Department of the Armenian Police, which acts only based on complaints from right holders and does not exercise ex-officio powers.

Despite the existence of relevant legislation and executive government structures, the concept of IPR remains unrecognized by a large part of the local population. The onus for IPR complaints rests with the offended party. Law enforcement assert that the majority of cases are settled through out-of-court proceedings. While the Armenian government has made some progress on IPR issues, strengthening enforcement mechanisms remains necessary. UNCTAD reports that low awareness and poor monitoring of IPR violations harm the business climate.

A new Law on Copyright has been drafted and submitted for government’s approval. It includes provisions from new international agreements (Marrakesh and Beijing Treaties). A new Law on Patents and Law on Industrial Design entered into force in July 2021. The new Law on Patents strengthens the requirement for substantive examination before rights registration and introduces the concept of a short-term patent. The new Law on Industrial Design includes some procedural changes, including publishing applications for industrial designs and objects during the state registration process.

Armenia is not included in USTR’s Special 301 Report or Notorious Markets List. For additional information about national laws and points of contact at local IP offices, please WIPO’s country profiles at http://www.wipo.int/directory/en/.

6. Financial Sector

CAPITAL MARKETS AND PORTFOLIO INVESTMENT

The banking system in Armenia is sound and well-regulated, but the financial sector is not highly developed, according to investors. Banking sector assets account for over 80 percent of total financial sector assets. Financial intermediation tends to be poor. Nearly all banks require collateral located in Armenia, and large collateral requirements often prevent potential borrowers from entering the market. U.S. businesses have noted that this creates a significant barrier for small- and medium-sized enterprises and start-up companies.

The Armenian government welcomes foreign portfolio investment and there is a supporting system and legal framework in place. Armenia’s securities market is not well developed and has only minimal trading activity through the Armenia Securities Exchange, though efforts to grow capital markets are underway. Liquidity sufficient for the entry and exit of sizeable positions is often difficult to achieve due to the small size of the Armenian market. The Armenian government hopes that as a result of pension reforms in 2014, which brought two international asset managers to Armenia, capital markets will play a more prominent role in the country’s financial sector. Armenia adheres to its IMF Article VIII commitments by refraining from restrictions on payments and transfers for current international transactions. Credit is allocated on market terms and foreign investors are able to access credit locally.

MONEY AND BANKING SYSTEM

Since 2020, the banking sector has withstood the twin shocks created by COVID-19 and the Nagorno-Karabakh conflict. Indicators of financial soundness, including capital adequacy and non-performing loan ratios, have remained broadly strong. The sector is well capitalized and liquid. Non-performing loans have ticked upward slightly from rates of around five percent of all loans. Dollarization, historically high for deposits and lending, has been falling in recent years. Seventeen commercial banks operate in Armenia. In 2021, all commercial banks in Armenia generated net profits and all had a positive return on average equity (the financial ratio that measures the performance of a bank based on its average shareholders’ equity outstanding). Total bank assets in Armenia at the end of 2021 were $14 billion; Armenia’s 2021 GDP was approximately $13.6 billion. As such, the ratio of banks’ total assets to GDP – approximately one-to-one – is average compared to peer countries. Concentration of banks’ assets is considered to be very low, with the three largest banks holding less than fifty percent of total banking sector assets. Market share of the largest five banks was 56 percent in 2021. Overall, Armenia’s banking sector is viewed by international financial institutions (IFIs) as relatively healthy.

The minimum capital requirement for banks is 30 billion AMD (around $59 million). There are no restrictions on foreigners to open bank accounts. Residents and foreign nationals can hold foreign currency accounts and import, export, and exchange foreign currency relatively freely in accordance with the Law on Currency Regulation and Currency Control. Foreign banks may establish a subsidiary, branch, or representative office, and subsidiaries of foreign banks are allowed to provide the same types of services as domestically owned banks.

The CBA is responsible for the regulation and supervision of the financial sector. The authority and responsibilities of the CBA are established under the Law on the Central Bank of Armenia. Numerous other articles of legislation and supporting regulations provide for financial sector oversight and supervision.

FOREIGN EXCHANGE AND REMITTANCES

Foreign Exchange

Armenia has no limitations on the conversion and transfer of money or the repatriation of capital and earnings, including branch profits, dividends, interest, royalties, or management or technical service fees. Most banks can transfer funds internationally within two to four days. Armenia maintains the Armenian dram as a freely convertible currency under a managed float. The AMD/USD exchange rate has been generally stable in recent years, but the dram experienced a notable depreciation against the dollar following the 2020 intensive fighting in and around NK but the dram stabilized in 2021The CBA maintains levels of reserves that are broadly seen as adequate.

According to the Law on Currency Regulation and Currency Control, prices for all goods and services, property, and wages must be set in AMD. There are exceptions in the law, however, for transactions between resident and non-resident businesses and for certain transactions involving goods traded at world market prices. The law requires that interest on foreign currency accounts be calculated in that currency but paid in AMD.

Remittance Policies

Armenia imposes no limitations on the conversion and transfer of money or the repatriation of capital and earnings, including branch profits, dividends, interest, royalties, lease payments, private foreign debt, or management or technical service fees.

SOVEREIGN WEALTH FUNDS

Armenia does not have a sovereign wealth fund.

7. State-Owned Enterprises

Most of Armenia’s state-owned enterprises (SOEs) were privatized in the 1990s and early 2000s, but SOEs are still active in a number of sectors. SOEs in Armenia operate as state-owned closed joint stock companies that are managed by the Department of State Property Management and state non-commercial organizations. There are no laws or rules that ensure a primary or leading role for SOEs in any specific industry. Armenia is party to the WTO Government Procurement Agreement, and SOEs are covered under that agreement. SOEs in Armenia are subject to the same tax regime as their private competitors, and private enterprises in Armenia can compete with SOEs under the same terms and conditions. The Department of State Property Management maintains a public list of state-owned closed joint stock companies on its website.

PRIVATIZATION PROGRAM

Most of Armenia’s SOEs were privatized in the 1990s and early 2000s. Many of the privatization processes for Armenia’s large assets were reported to be neither competitive nor transparent, and political considerations in some instances prevailed over fair tender processes. The most recent law on privatization, the fifth, is the Law on the 2017-2020 Program for State Property Privatization, which lists 48 entities for privatization. The Department of State Property Management oversees the management of the state’s shares in entities slated for privatization. Details of the privatization program are available on the Department of State Property Management website.

8. Responsible Business Conduct

Comprehension of responsible business conduct (RBC) in Armenia is still developing, but several larger companies with foreign ownership or management have been operating under the concept in recent years. Initiatives, where they do exist, are primarily limited to corporate social responsibility efforts. However, RBC programs that do exist are viewed favorably. Some civil society groups and business associations are playing a more active role to promote RBC and develop awareness. Major pillars of corporate governance in Armenia include the Law on Joint Stock Companies, the Law on Banks and Banking Activity, the Law on Securities Market, and a Corporate Governance Code. International observers note inconsistencies in this legislation and generally rate corporate governance practices as weak to fair. Specific areas for potential improvement cited by the local business community include improving internal and external auditing for firms, enhancing the powers of independent directors on company boards, and boosting shareholders’ rights. Armenia has outlined commitments to corporate governance reforms, including with regard to mandatory audit, accounting, and financial reporting, within the context of an ongoing Stand-By Arrangement with the International Monetary Fund.

Armenia joined the Extractive Industries Transparency Initiative (EITI) in March 2017 as a candidate country. The first EITI national report for Armenia was published in January 2019. As part of its EITI membership aspirations, the government in March 2018 adopted a roadmap to disclose beneficial owners in the metal ore mining industry. Relevant implementing legislation, including for beneficial ownership disclosure, was adopted in 2019.

Armenia is not a signatory to the Montreux Document on Private Military and Security Companies, and no Armenian party is a member of the International Code of Conduct for Private Security Providers’ Association.

Domestic laws and regulations related to labor, employment rights, consumer protection, and environmental protection are not always enforced effectively. These laws and regulations cannot be waived to attract foreign investment.

ADDITIONAL RESOURCES

Department of State

Country Reports on Human Rights Practices;

Trafficking in Persons Report;

Guidance on Implementing the “UN Guiding Principles” for Transactions Linked to Foreign Government End-Users for Products or Services with Surveillance Capabilities;

U.S. National Contact Point for the OECD Guidelines for Multinational Enterprises; and

Xinjiang Supply Chain Business Advisory.

Department of the Treasury

OFAC Recent Actions

Department of Labor

Findings on the Worst Forms of Child Labor Report;

List of Goods Produced by Child Labor or Forced Labor;

Sweat & Toil: Child Labor, Forced Labor, and Human Trafficking Around the World; and

Comply Chain.

Climate issues

Armenia recently started mainstreaming and integrating climate change considerations into its national and sectoral development policies. The National Action Program of Adaptation to Climate Change and the List of Measures for 2021-2025 was approved in May 2021 and includes measures on the monitoring of biodiversity and ecosystems. Armenia’s Nationally Determined Contributions (NDC) for 2021-2030 under the Paris Agreement was adopted in April 2021 and submitted to the UNFCC Secretariat in May 2021. It sets the new unconditional mitigation target of a 40 percent reduction below 1990 emission levels, to be achieved by 2030. Development of mid-century LNG-Term Low Emission and Development strategies in Armenia is envisaged within the framework of the EU4Climate project. Starting January 1, 2022, regulation to ban single-use plastic bags in retails stores entered into force and during 2022 it is expected that sale and distribution of plastic bags thicker than 50 microns will be banned as well. The Government recently prolonged VAT exemption for the import of electric vehicles through 2024. The Government also passed legislation that allows for free parking of electric vehicles in Yerevan.

9. Corruption

RESOURCES TO REPORT CORRUPTION

Contact at the government agency or agencies that are responsible for combating corruption:

Anti-Corruption Committee (ACC)

13A Vagharsh Vagharshyan Street Yerevan, Armenia

+374 11 900 002

[email protected]

Contact at a “watchdog” organization: Sona Ayvazyan Executive Director

Transparency International

Anti-Corruption Center 12 Saryan Street Yerevan, Armenia

+374 10 569 589

[email protected]

Following 2021 parliamentary elections that international monitors assessed as upholding fundamental rights and freedoms, the Armenian government’s commitment to eradicating corruption continues. Policy action and systemic change remain strong, and the government has pressed forward with legislative actions to establish investigative, prosecutorial and judicial anti-corruption institutions. The government’s anti-corruption agenda is outlined in a 2019–2022 strategy and action plan. These documents establish a new anti-corruption institutional framework with separate entities tasked with preventive, investigative, and prosecutorial functions as well as the Specialized Anti-Corruption Court. Established in 2019, the Corruption Prevention Commission (CPC) is the main entity responsible for preventing corruption and building integrity across government and society. CPC continued to make progress in the areas of asset declaration and integrity checks but has yet to fulfill its mandates for oversight of political party financing and prevention of conflicts of interest. The Anti-Corruption Committee, as an investigative body, was established in September 2021 to lead pre-trial criminal proceedings on alleged corruption crimes by carrying out both investigative and operative intelligence activities. The amendments to the Judicial Code on establishing the Specialized Anti-Corruption Court (SACC) were adopted on April 14, 2021, thus marking the completion of the creation of the government’s new institutional framework to fight corruption. The SACC is the first instance court, and the judges specialized in anti-corruption cases will sit at the Criminal Court of Appeals and the Anti-Corruption Chamber of the Cassation Court. As a follow-up to the passage of the Law “On Civil Forfeiture of Illegal Assets,” the department dealing with cases of civil forfeiture of illegal assets was established in September 2020 within the General Prosecutor’s Office.

Civil society actors are divided in their opinions about the effectiveness of the government’s anti-corruption measures. Some assess the implementation of the anti-corruption program is on track, while others contend that the work of law enforcement and judiciary on corruption cases is not effective enough, citing already opened criminal cases on corruption and embezzlement that do not reach completion.

Corruption remains an obstacle to U.S. investment in Armenia, particularly as it relates to critical areas such as the justice system and concerns related to the rule of law, enforcement of existing legislation and regulations, and equal treatment. Investors claim that the health, education, military, corrections, and law enforcement sectors lack transparency in procurement and have in the past used selective enforcement to elicit bribes. Judges who specialize in civil cases are still widely perceived by the public to be corrupt and under the influence of former authorities. The effectiveness and independence of newly formed anti-corruption institutions remains to be seen. Some individuals have voiced concerns around whether certain judicial representatives and law enforcement leaders have been selected objectively. The potential for politically motivated, outside influence on these anti-corruption institutions, as well as law enforcement bodies and prosecutorial services, also remains a concern.

Transparency International released its Corruption Perception Index (CPI) 2021, ranking Armenia 58th among 180 countries. According to the report, Armenia’s CPI score in 2021 remained unchanged compared to 2020 (score of 49). Armenia’s rating is higher than the CPI global average of 43, indicating Armenia’s public sector was perceived by experts and businesspeople to be less corrupt than the global average. Among 19 countries in Eastern Europe and Central Asia, Armenia ranked the second highest. The report cited Armenia as among the countries which has registered significant progress in the last decade. (In his December 2021 Summit for Democracy speech, Prime Minister Pashinyan noted Armenia aims to rise from a score of 49 to 60 in Transparency International’s Corruption Perception Index by 2026.)

Various laws prohibit the participation of civil and municipal servants, as well as local government elected officials such as mayors and councilors, in commercial activities. However, powerful officials at the national, district, and local levels often acquire direct, partial, or indirect control over private firms. Such control is often exercised through a hidden partner or majority ownership of fully private parent companies. This involvement can occur through close relatives and friends. According to foreign investors, these practices reinforce protectionism, hinder competition, and undermine the image of the government as a facilitator of private sector growth. Because of the historically strong interconnectedness of the political and economic spheres, Armenia has often struggled to introduce legislation to encourage strict ethical codes of conduct and the prevention of bribery in business transactions. In 2016, Armenia adopted legislation on criminal penalties for illicit enrichment and noncompliance or fraud in filing declarations.

Armenia is a member of the UN Convention against Corruption. While not a party to the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, Armenia is a member of the OECD Anti-Corruption Network for Eastern Europe and Central Asia and has signed the Istanbul Action Plan. Armenia is also a member of the global Open Government Partnership initiative.

No specific law exists to protect NGOs dealing with anti-corruption investigations.

10. Political and Security Environment

Armenia has a history of political demonstrations, most of which have remained peaceful. There have been some instances, however, of violent confrontations between police and protesters, or of attacks on government officials. The last major violent protest occurred in November 2020 following the release of a tripartite ceasefire statement by Armenia, Azerbaijan, and Russia, which brought an end to the fall 2020 intensive fighting in and around NK. Individuals and groups displeased with the announcement stormed government buildings and destroyed property. Protestors assaulted the speaker of parliament in the streets of Yerevan and broke into the prime minister’s residence. Since the release of the tripartite statement, groups opposed to the government have organized regular marches and rallies in Yerevan that have remained largely peaceful and caused minimal disruption to ordinary business. Pro-government groups have also organized peaceful rallies, although less frequently.

Throughout Armenia, protestors use road blockades as a common tactic to register discontent, most often with the government over community-level issues. The disruption created by such road blockades is usually minimal. Protests have not resulted in any damage to projects of installations of international businesses. It is unlikely that civil disturbances, should they occur, would be directed against U.S. businesses or the U.S. community.

During 44 days of intensive fighting from September 27 to November 10 in 2020 involving Azerbaijan, Armenia, and Armenia-supported separatists, significant casualties and atrocities were reported by all sides. After Azerbaijan, with Turkish support, reestablished control over four surrounding territories controlled by separatists since 1994, a Russian-brokered ceasefire arrangement announced by Azerbaijan and Armenia on November 9 resulted in the peaceful transfer of control over three additional territories to Azerbaijan, as well as the introduction of Russian peacekeepers to the region. The ceasefire has largely held, with frequent but localized violations. Tensions remain high, particularly along the international border, which has not been fully demarcated.

Russian forces have played a role in controlling access along highways near the border and into the Nagorno-Karabakh region from Armenia and Azerbaijan. The Azerbaijani government has suspended or threatened to suspend the operations of U.S. companies in Azerbaijan whose products or services are provided in the area of Nagorno-Karabakh currently under the administration of the Russian peacekeepers and has banned the entry into Azerbaijan of some persons who have visited NK. The U.S. government is unable to provide emergency services to U.S. citizens in and around NK as access is restricted.

11. Labor Policies and Practices

Armenia’s human capital is one of its strongest resources. The labor force is generally well educated, particularly in the science, technology, engineering, and mathematics fields. Nearly 100 percent of Armenia’s adult population is literate. According to official data, enrollment in secondary school is over 90 percent, and enrollment in senior school (essentially equivalent to American high school) is approximately 85 percent. Despite this, official statistics indicate a high rate of unemployment, at around 20 percent. Unemployment is particularly pronounced among women and youth, and significant underemployment is also a problem.

Considerable foreign investment in Armenia has occurred in the high-tech sector. High-tech companies have established branches or subsidiaries in Armenia to take advantage of the country’s pool of qualified specialists in electrical and computer engineering, optical engineering, and software design. There is a shortage of workers with vocational training. About 20 percent of the non-agricultural workforce is employed in the informal economy, primarily in the services sector. Armenian law protects the rights of workers in the formal sector to form and to join independent unions, with exceptions for personnel of the armed forces and law enforcement agencies. The law also provides for the right to strike, with the same exceptions, and permits collective bargaining.

The law stipulates that workers’ rights cannot be restricted because of membership in a union. It also differentiates between layoffs and firing with severance. According to some reports, labor organizations remain weak because of employer resistance, high unemployment, and unfavorable economic conditions; collective bargaining is not common in Armenia. Experts observe that the right to strike, although enshrined in the constitution, is difficult to realize due to mediation and voting requirements. Labor unions are generally inactive with the exception of those connected with the mining and chemical industries, and a few small grassroot movements to create unions in the fields of education and public health have sprung up over the last few years. Labor laws cannot be waived to retain or attract investment.

The current Labor Code is considered to be largely consistent with international standards. The law sets a standard 40-hour workweek, with 20 days of mandatory annual paid leave. However, there are consistent reports that many private sector employees, particularly in the service sector, are unable to obtain paid leave and are required to work more than eight hours a day without additional compensation. The treatment of labor in FEZs is no different than elsewhere in the country. Employers are generally able to adjust employment in light of fluctuating market conditions. Severance in general does not exceed 60 working days. Benefits for workers laid off for economic reasons are mostly limited to receiving qualification trainings and job search assistance.

Individual labor disputes can usually be resolved through courts; however, the courts are often overburdened, causing significant delays. Collective labor disputes should be resolved through collective bargaining.

Since 2019, Armenia’s Health and Labor Inspection Body (HLIB) has gradually begun to exercise more robust enforcement of labor legislation and fulfill its oversight function. Its full mandate came into force in July 2021. Throughout 2021, the government continued to adopt inspection checklists and risk assessment methodologies in various sectors to enable HLIB to carry out inspections. HLIB also continued to add new inspectors throughout the year.

Amendments to the Labor Code that entered into force in 2015 clarified the procedures for making changes in labor contracts and further specified the provisions required in labor contracts, notably those relating to probationary periods, vacation, and wage calculations.

The current legal minimum wage is AMD 68,000 (approximately $135) per month. Most companies pay an unofficial extra-month bonus for the New Year’s holiday. Wages in the public sector are often significantly lower than those in the private sector.

12. U.S. International Development Finance Corporation (DFC), and Other Investment Insurance or Development Finance Programs

The United States and Armenia maintain an investment incentive agreement, signed in 1992, that serves to mobilize private capital via the U.S. International Development Finance Corporation (DFC). DFC can help solve critical development challenges by mobilizing private capital as well as providing investors with financing, guarantees, political risk insurance, and support for private equity investment funds. DFC’s predecessor organization, the Overseas Private Investment Corporation, has been involved in several projects in Armenia, including the expansion of the Armenia Marriott Hotel in Yerevan and lending operations at several financial institutions. In 2019, OPIC concluded a deal to extend $10 million in financing to First Mortgage Company to expand the origination of long-term home mortgage loans. Armenia is a member of the World Bank Group’s Multilateral Investment Guarantee Agency.

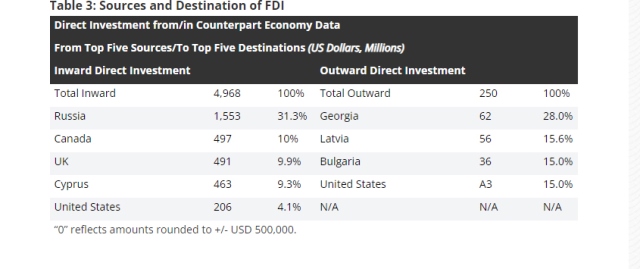

13. Foreign Direct Investment Statistics