What happens when things are held upside down

Acting minister of economy Tigran Davtyan recently convened a discussion at his office for the purpose of tackling the situation in the construction market and future prospects.

The meeting was held in participation of representatives from state institutions, construction unions, institutions, companies, international organizations and other stakeholders. Tigran Davtyan said that even though the economy had grown during the last year, the sector of construction failed to register growth (declined by 8%), and that the Prime-Minister was paying attention to the sector of construction. “The purpose of our meeting is to discuss the problems and challenges in the sector of construction and understand what potential support the government can offer to help the development of this sector,” said Tigran Davtyan.

It seems there is nothing extraordinary and this is a normal working process, however the real challenges of the construction sector are not inside that sector. Construction is a sector that gives a product which is in demand, i.e. there are consumers ready to buy. Main potential buyers of this product are citizens, i.e. people who want to own a house. If the volume of construction is falling, it means the demand is falling too. The tendency of real estate price reduction and also fewer sales transactions show that there is lower demand now.

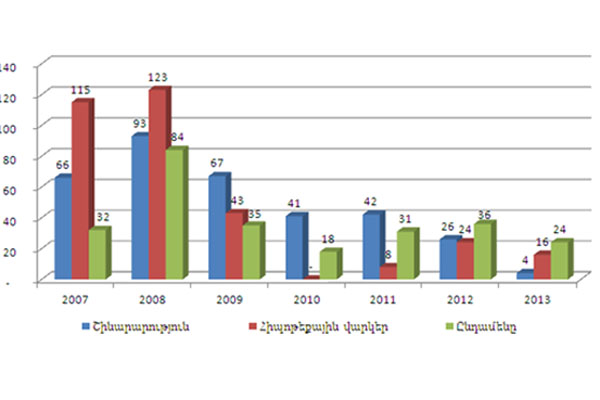

The chart below illustrates the growth of bank credits issued generally, for real estate and for construction specifically too. The chart illustrates the credit volumes issued in the end of February of every month, compared to the volume of

the same period in the previous year.

For example, in the end of February 2013 the volume of mortgage credits amounted 127.5 billion drams, and the volume of credits in general – 1,551.6 bln. Drams. The entire volume of issued credits grew by 24% compared to 2012. Meanwhile, the tendency of growth in mortgage credit borrowing was lower at 16%. The volume of credits issued for construction purposes grew by 4%.

Tendency of growth in bank credits (%)

In 2007, for example, the situation was different: the total volume of credits had grown by 32%, the volume of credits financing construction had grown by 66%, and the volume of mortgage credits – by 115%.

The situation was similar in 2008, which means that the demand for mortgage credits was growing faster than the demand for any other type of bank borrowing. This means that there was a lot of demand for real estate property as people were buying. During the first year of the crisis cycle, the level of this demand stayed the same, but the direction of the tendency changed.

In 2010 the volume of mortgage credit borrowing did not grow, in case when the volume of total bank credits grew by 18%.

As of February 2012 & 2013 the volumes of credits issued for financing construction and real estate transactions were much lower than the volume of the total credit volume. This is very strange in consideration of the fact that there are a number of projects that encourage youth to buy apartments. Due to these projects the interest rates have been reduced, but the level of transactions has not increased. Due to low demand, the volumes of new construction projects are low too.

The reason why the demand for real estate is not growing is very simple and in the meantime very painful: people do not connect their future with Armenia. For example, according to a recent survey by Gallup, 40% of Armenians are ready to emigrate if they have any opportunity to resettle. This means that even if people have money, they would prefer to resettle and establish themselves in other countries than buying property in Armenia.

According to the information of the Armenian Migration Service, the difference between departures and arrivals in January & February of this year was 22,100. This is a record as it is the highest number of ridership difference so far. In one of the upcoming editions we will also publish information about emigration statistics for January-March to see the impact of the presidential election on the level of emigration and demand for real estate properties.

In a word, it would be better to look for the reasons of low volume of construction investments and low demand for real estate among the reasons of emigration. Instead of doing this, the government is holding things upside down and discussing the reasons with construction companies. It is not surprising that after all these efforts, the tendency of construction growth is falling down, again upside down.

By Babken Tunyan