“Masochism” of Armenian banks

Former Prime Minister Hrant Bagratyan has developed a bill to the parliament aimed at strengthening the national currency.

The first bill proposes to prohibit foreign currency rates in Armenia starting from January 1st 2014 (the Armenian government’s conclusion statement writes that “foreign currency rate” term is not understandable). The second bill proposes changes to the law on banks and banking policies to establish that starting from January 1st 2014 bank loans shall be provided exclusively in the national currency. This means that Bagratyan proposed the bills aimed at prohibiting loans in foreign currency. Bagratyan believes this amendment will allow all companies and entrepreneurs act in equal conditions in order to strengthen the national currency and save the reserves in foreign currencies. The government has refused the bills as it finds these changes are not feasible. The government’s response writes that the government is concerned of the dollarization level of the economy, too, and “supports efforts aimed at increasing the trust to the national currency and strengthening it.” However, the government mentions that the existing legislation can solve the problem. The most interesting part is about loans. In the beginning the government claimed that in Armenia consumer loans are provided by financial institutions exclusively in AMD, and foreign currency loans are issued for businesses as they are doing trade with their partners in other countries. Subsequently the government emphasized that there are normative that establish rules for actives in the national and foreign currencies, and the regulations for foreign currency is stricter. As a result of this regulation for financial institutions it is more expensive to issue loans in foreign currencies, thus financial institutions are less interested in issuing loans in foreign currencies.

This statement is worth looking at. This means that banks would like to provide loans in drams, but as businesses are more interested in loans in dollars, banks are compromising a part of their income by issuing loans in dollars. This is what the government’s statement is trying to say. However, anecdotal evidences from businessmen say that for long-term and bigger loans banks push loans in dollars. In addition to the normative strict policies for issuing loans in foreign currencies, banks have one more “volunteer loss” in issuing loans in foreign currencies as they offer such loans with 0.5-1% cheaper interest rate.

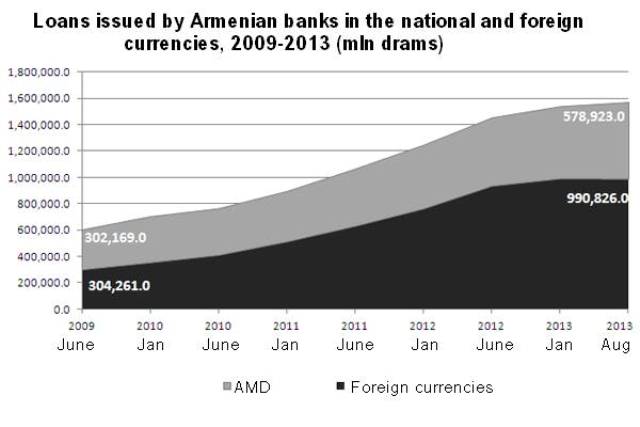

This means that banks are offering loans in foreign currencies at cheaper rates. Now the most important part is coming. In fact the more the government is trying to reduce the level of dollarization and the more targeted policies are restricted, the more loans in foreign currencies are issued by banks. The official statistics shows the same thing. According to the National Statistical Service, in 2009 crediting investment volume on the part of banks (loans issued) was AMD606.4 billion. Volume of loans in AMD was 302.2 billion, and in foreign currencies – 304.2 billion.

In the end of August 2013 the volume of loans was AMD1,569.7 billion (higher by 2,5 times compared to 2009). AMD990.8 billion out of this amount (63.1%) is loans in foreign currencies. Foreign currency loan portfolio of Armenian banks increased by 3.2 times, and that of AMD – by 1.9 times (from 302.2bln grew to 578.9bln). The conclusion is that during the past four years Armenian banks accrued losses voluntarily by stimulating loans in foreign currencies. This was done for the sake of the business and economic activity because, as the government’s statement says, rapid limitation of loans in foreign currencies in the current situation could lead to reduction of economic activity in Armenia.

Everyone understands that this could not happen. Banks, especially Armenian banks, never do anything against their financial interests. If banks issue loans with law profit, they should at least have some other benefit to do that. One of such benefits is trust – trust toward foreign currencies. Banks are more interested to issue large loans for ten years in dollars and with lower interest rate. Nobody in Armenia knows what will happen to the national currency in ten years. This is true especially now, when it is not excluded that in the near future the Armenian dram may be substituted by the Russian ruble. This means that the one to benefit from loans in foreign currencies are not businesses or the economy but banks.

By Babken Tunyan