Competitive and investing balloons

On these days the Armenian parliament is discussing the report of the Economic Protection State Committee and the actions anticipated for this year.

Indeed, the chair of the committee Artak Shaboyan was presenting the achievements by mentioning that during the past three years Armenia has essentially improved its positions in the list any-monopoly states. “In fact this change is reaching serious amounts. Compared to a few Eastern European and Baltic states we are even leading on this chart,” he said. Of course Shaboyan appeared in an awkward situation because the journalists reminded him of the World Bank report and a few other hideous facts. Seems like we already said what had to be said but we think it’s wouldn’t be spare to once again speak about the competitive field of Armenia.

Competition balloon

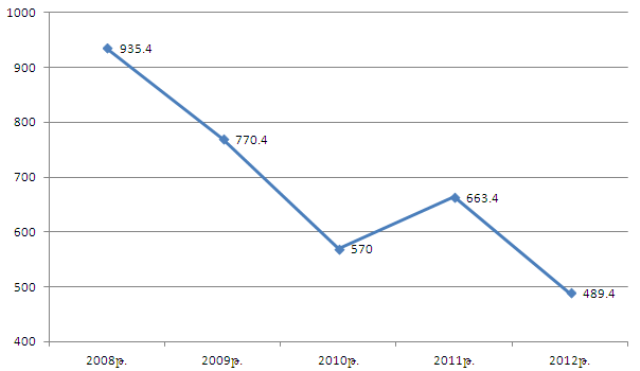

First of all, it wouldn’t be a formal goal to improve competition in Armenia. It should be improved at the expense of the increase of foreign and domestic investments, where there would be no need for “government backing.” It means if Shaboyan is right and in the past three years the situation has improved in Armenia it should have at least slightly conduced to the increase of investments. Now let’s see that changes we have had in the sector of foreign investments “picture 1”.

The largest inflow of Direct Foreign Investments (DFI) was recorded in 2008 in the amount of 935.4 million USD. In 2009 the volumes of DFI dropped to 770,4 million USD. Back then we agreed that this might be a consequence of the crisis. In 2010 the figure reached 570 million USD. In 2011 there was a slight growth of investments and those reached 663.4 million. It seemed we overcame the global crisis and were expected to record ongoing growth for the next years to come. The Doing Business suggested that Armenia is improving its market and conditions to do business. But in 2012 foreign investments literally slumped up to 26% and amounted to 489,4 million USD. And in 2013 the picture was even sadder. The summarized indexes of the year are not ready yet but according to the National Statistics Service in January-September DFI in Armenia reduced by 62,1% (about three times) and amounted to 409,6 million. So we should sadly record that in 2013 the picture is dire. Under these circumstances we have two options.

Either these statements are too far from reality or in the case of Armenia economic data have a contrary effect. The better doing business in Armenia becomes the lesser the interest of foreign businesses becomes to Armenia. All these facts made us advert to another investment balloon. During his end of the year press conference Prime Minister Tigran Sargsyan mentioned why the foreign investment rates are dropping. Exactly the question caused the distant debate between Tigran Sargsyan and former president of Armenia Robert Kocharyan. The Premier said that the problems should be sought in the construction sector. By reminding that before the global crisis the main locomotive economic boost was construction Tigran Sargsyan said, “When the balloon of construction was inflated and it blew up it created many negative effects. We had an inflation of 15-20% and many other branches of economy have become uncompetitive. The financial means from industry were directed to construction. Back then it made more sense to shut down a factory, buy an apartment and a year later sell it at a higher price. When the balloon blew up the financial means appeared with the owners. ” The theme of the balloon has been discussed many times but it hasn’t been discussed in this angle. Yes maybe many people would shut down their factories and buy apartments but it mostly took place at the expense of internal resources. For example, if a foreign citizen buys a building in Armenia it is a foreign investment but not a direct one. It would be a direct investment if the foreigner spent money to build this building.

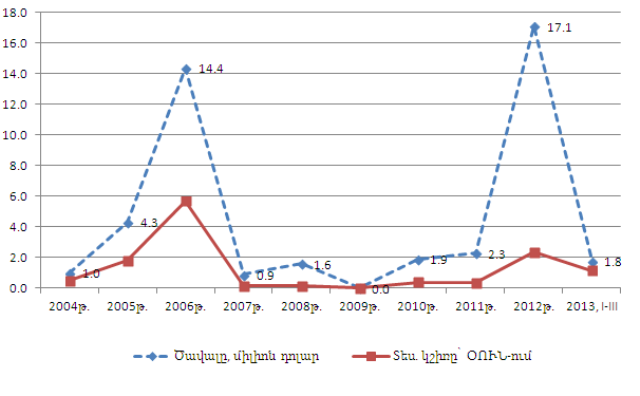

In order to understand the role of foreign investments in construction in direct investment portfolio, let’s discuss which part of such investments were directed at building construction (where the “balloon” was). This will help us understand how much of constriction work was done by foreign capital.

This information can be found in the web site of the National Statistical Service. There is a separate group of investment in the construction sector, which shows separately how much money was invested in building construction. The second picture was made based on that information (See Picture).

This picture shows that, for example in 2004 only 0.5% of foreign investment was spent on building construction (approximately $1 million). The highest rate during the time when Robert Kocharyan was in office was in 2006, when the construction volume that was done on the expense of foreign capital investment amounted to $14.4 million.

Generally in the period of 2004-2013 the volume of construction on the expense of foreign investment was $45.3 million only. We say “only” because it amounts to 1 per cent of the direct investment in Armenia’s economy from outside during the past ten years.

This means that the slump in the construction sector did not affect the foreign investment inflow much as the foreign capital, according to official statistics, did not fund large investments in Armenia, even during the years of the construction book.

In a word, no state official has given a good answer yet to describe why the volume of investments is going down.

By Babken Tunyan