Panamanian Offshore not Our Favorite

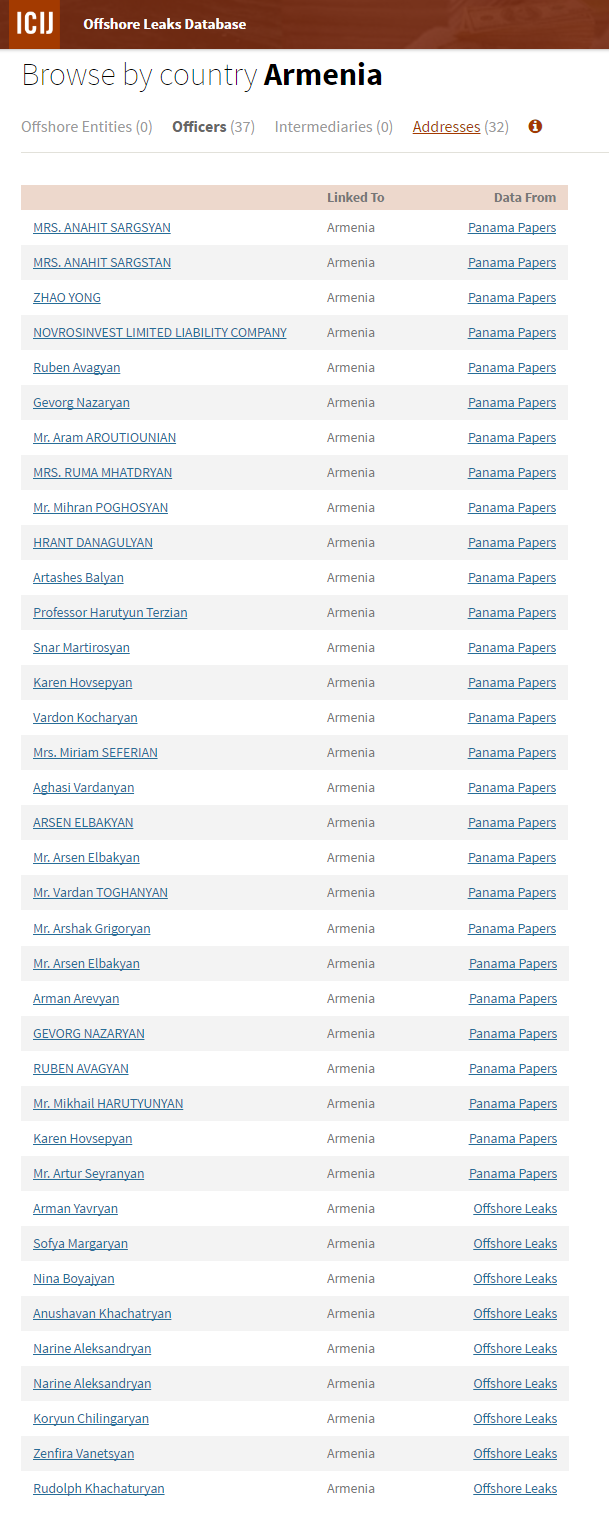

The International Consortium of Investigative Journalists (ICIJ) released the list of 214 000 persons engaged with offshore companies and structures on May 9. Just in a few minutes names of three dozens of Armenians included in offshore structures were published on Armenian media outlets. Mihran Poghosyan, former head of Armenia’s Compulsory Enforcement Service, was among them, who resigned due to the Panamanian scandal. ICIJ database has become the hit of Armenia’s economic newsfeed since May 9.

Reporters attempt to find out who are the people included in the list and what kind of offshore deals they concluded, on the other hand, they want to clarify what steps the responsible bodies will initiate in this regard.

And why do we say, that the Panamanian offshore is not our favorite? As while observing data of CIS countries, interest from Armenia towards this offshore zone is rather weak.

Names of 37 officers from Armenia are included in ICIJ database (directors, shareholders, beneficiaries), 4 of which are repeated. Entities linked to Armenia aren’t found in ICIJ database (entities include companies, foundations and etc). Mediators (e.g. lawyers), helping shareholders to register offshore businesses or appearing in their names, are not found as well.

For comparison, 11516 entities and 6285 officers interrelated to Russia may be found in ICIJ database.

Data for all former USSR states are included in the Table, sequence of which is defined by the number of officers and entities, available in ICIJ database. Russia is in the lead. Of course, Russia’s figures may be explained by population and economy volumes. However, the fact of Lithuania’s being on the second place edifies, that number of population in this case is not essential.

Offshore presence of Latvians in ICIJ database exceeds Armenia by 80 times (2941 entities, 162 officers). Of course, Lithuania’s GDP is three times more than that of Armenia, however, this country yields by the number of population (about 2 million).

Turkmenistan, Tajikistan and Kyrgyzstan have fewer participants, than Armenia. On the whole, 23967 entities and officers from former USSR states have been registered in this offshore database. Armenia’s participation in it comprises 0.15%.

Does it mean that we, Armenians, don’t love offshore deals and don’t attempt to hide our money there? Of course—not. Even official statistics shows that a considerable part of investments in real sector of economy come from the offshore zones. In case of a range of deals, which obtained public response, deal with offshore enterprises (e.g. in case of “Dvin” hotel). Note also, that one of the managers of Armenia’s pension funds—C-Quadrat Ampega Asset Management Armenia, is partially an offshore company. It’s 74.9% belongs to C-Quadrat Investment AG, which by 9.4% belongs to Laakman Holding offshore company.

Our modest participation in the Panama Papers may be explained in two ways. Either Armenia’s “Koreykos” give preference not to the Panamanian, but to other offshore zones, or they became so skilled in the offshore structures, that are able not to leave any Armenian trace. Or, the third variant—both of them (which is more probable).

Is an offshore company such a bad thing? Once we wrote, that offshore, isn’t such an awful thing in itself. It’s simply a financial center, where tax conditions and procedures of doing business are maximally simplified. This means, companies are registered on offshore zones to pay less taxes and work easily. Main reason for negative attitude towards offshore companies is their being non-transparent—information on owners and origin of money are almost unreachable. That’s the reason, that citizens, and in some cases, even state structures show conditional approach to offshore enterprises and their activity.

Vakhtang Mirumyan, chairman of State Revenue Committee (SRC), touching upon uncovering of the Panama Papers yesterday, said Armenia’s legislation doesn’t ban offshore companies to correlate with Armenian enterprises, “If taxes are paid in the offshore, should it be clarified if it acts pursuant offshore legislation or not? And what is our current issue—uncovering does it regularly pay them or not? RA legislation doesn’t ban offshore companies to collaborate with Armenian enterprises. It’s another question, can the Armenian enterprise as a result pay less taxes or not?”

Surely, in this regard there are no grounds for making a tragedy of the offshore. However, offshore is perceived by wider part of the society as a place, where our officials hide money looted from the society. Research by James Henry, professor at Columbia University, on offshore companies was published a few days ago. The scientist, touching upon the “residents” of offshore zones, made the following comparison, “It’s like the Star Wars scene: you have the tax dodgers in one corner, the arms dealers in another, the kleptocrats over here. There’s also those using tax havens for money laundering, or fraud.”

From our corner, not the offshore, but the fact in which corner and in whose company our compatriots are found, is crucial here.

By Babken Tunyan