Where are We Cheated?

The Tax Code, importance and value if which is being repeatedly highlighted both by authorities and international structures, yet not adopted, is criticized by specialists.

Problematic provisions are more, however, income tax is the most discussed topic. Specialists say that Tax Code will overload tax burden of the middle class.

Is that really true?

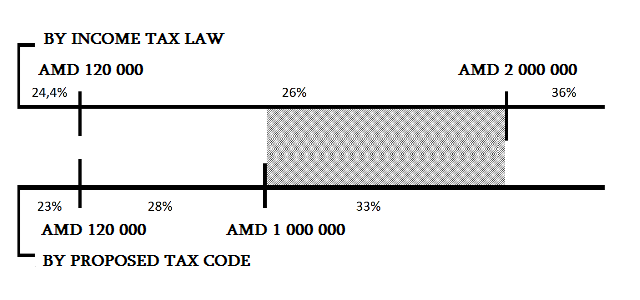

Under the current legislation the following rates for income tax are defined:

Up to AMD 120 000—24.4%, or AMD 29 280

AMD 120 001 – 2 000 000 — AMD 29 280 plus 26% of the amount exceeding AMD 120 000

More than AMD 2 000 000 — AMD 518 080 plus 36% of the amount exceeding AMD 2 000 000.

The following rates are defined (Article 105) pursuant the Tax Code:

Up to AMD 120 000— 23%,

AMD 120 001— AMD 1 000 000 — AMD 27 600 plus 28% of the amount exceeding AMD 120 000,

More than AMD 1 000 000— AMD 274 000 plus 33% of the amount exceeding AMD 1 000 000.

At first sight everything is ok, even disburden of taxes is observed. For instance, income tax of those getting salary up to AMD 120 thousand comprises 23% (instead of current 24.4%). Taxation of higher salary also reduced from 36% to 33%.

However, taxation rate for salary higher than AMD 120 thousand was raised by 2 percentage points. And the biggest secret is behind the line.

As it’s observed from the Chart, on the one hand, the Tax Code proposes to raise taxation of salaries exceeding AMD 120 thousand from 26% to 28%, and to reduce the line up to AMD 1 million on the other.

Thus, it turns out, that from AMD 1 million to 2 million not 26%, but 33% is charged. Figuratively speaking, the Government moves AMD 1 million to a higher taxation field. Bold parts in the Chart reveal that.

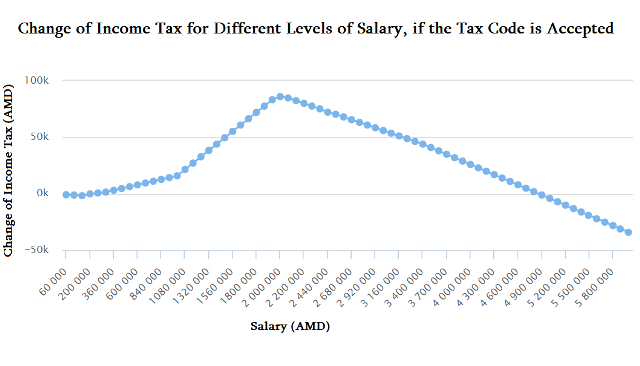

As a result, those earning AMD 200 thousand salary benefit a little, by paying AMD 1000-1700 less income tax monthly. And in case of salaries exceeding AMD 200 thousand, more income tax is paid.

It’s worth introducing concrete examples. The one obtaining AMD 120 thousand today pays AMD 29 280 income tax, and pursuant the Tax Code AMD 27 600 will be paid (less by AMD 1 680).

In case of AMD 200 thousand, the change is not so considerable—AMD 50 000 instead of AMD 50 080.

For AMD 280 thousand salary, the income tax will comprise AMD 72 400, instead of AMD 70 880 (less by AMD 1520).

For AMD 400 monthly salary tax burden will be added by AMD 3920, for AMD 600 thousand—by AMD 7900, and for AMD 1 million—by AMD 15 900. In case of AMD 2 million they have to pay AMD 604 thousand instead of previous AMD 518 080, which is more by AMD 86 thousand.

The most noteworthy here is the fact that the Tax Code is beneficial for those getting AMD 4.9 million and more—they’ll pay less income tax. It turns out, that those getting lower salaries make little benefit, and it’s more favorable in case of superhigh salaries (top management of grand companies).

Main burden lies on average and higher-than-average salaries. Those getting more than average suffer the most—mainly IT specialists and those working in the field of finance.

That’s why complaint again matures in these very circles. That’s the reason that many regard these provisions of Tax Code as a blow to the middle class.

On account of the fact, that average salary comprises AMD 181 thousand, some will say importance of the issue is exaggerated: very few people get AMD 300-400 thousand registered salary, and those getting AMD 1 million and more are quite few.

There is no exact statistics to understand how many employees we have for various salary levels. However, approximate figures may be observed.

According to official statistics, as of February 2016 the highest salary is obtained in the following fields: financial and insurance activity (AMD 373555), information and connections (AMD 366323), mining (AMD 342631), electricity, gas, high-quality steam and air supply (AMD 259662).

According to that very statistics, in these four fields altogether 66900 thousand employees may be found. About 2000 employees and the managing staff of big companies may be added to this. We’ll have 70 thousand employees getting salaries more than average. This comprises 6.5% of total workforce. And if we consider that the line getting AMD 300 thousand together with his/her family is a representative of the middle class, then it’ll turn out, that the middle class comprises 6-7%.

Pursuant assessments of the World Bank in case of looking into the issue, the snapshot is rather disappointing. According to its report issued recently, number of those consuming more than USD 10 daily per capita comprise about 3% of Armenia’s population. Thus, from this perspective, middle class comprises less number.

Some will say—is it worth complaining of the Tax Code for a few percents? However, on the other hand, economy is based on these very highly qualified specialists comprising just a few percents. And the role of IT, in particular, after the April military operations, is strongly highlighted and is not limited within economic platform only. Note also, that overloading of tax burden is pregnant with the threat of shadow economy increase.

In any case, the Tax Code hasn’t been adopted yet and will be in force after 2018. Thus, it is not excluded that income tax rates and line will be reviewed.

By Babken Tunyan