Where and in Which Currency should be Money Kept?

These questions have repeatedly worried Armenia’s citizens, who succeeded to save more or less from the money earned.

The first question is—where to keep money? Under the matrass or in the bank? Or would it be better investing in any business or property?

Dissipation of savings in Soviet banks has left a track in sub-consciousness of the citizens. Thus, trust towards the banking system was rather low. And when that already low trust started to be restored little by little, another disappointing reason emerged—banks, which opened and went bankrupt, financial pyramids in the first years of independence.

However, with time our citizens found power in themselves and again started to trust in banks. Money was moved to the banking system.

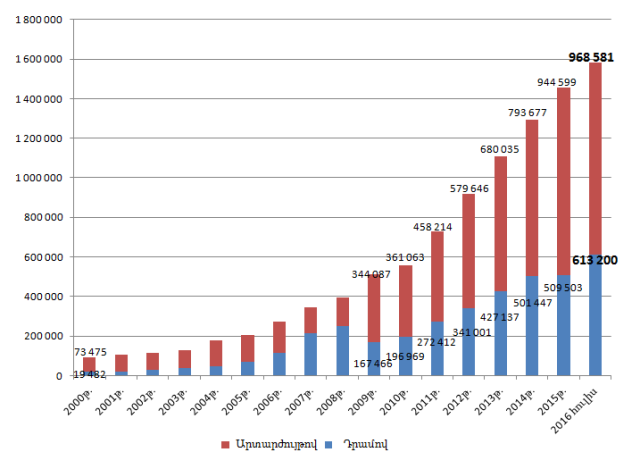

It’s worth bringing some data to show that move. As of late 2000 growth of trade banks’ deposits received from Armenia’s residents comprised just AMD 93 billion (both term deposit and accounts). From that amount AMD 19.5 billion belong to deposits in Armenian dram (AMD), and 73.5 billion, with US dollar (USD).

As of late July 2016 we have the following snapshot—total deposits comprising AMD 581.8 billion, from which AMD 613.2 and deposits in US dollar—AMD 968.6 billion.

Thus, in the period of 15 years deposits of Armenia’s residents kept in trade banks grew 17 times, including deposits in Armenian dram—31.4 times.

This speaks not only of income growth, but trust growth towards other banks. The Table below shows how deposits have grown in the period of 2000-2016 by currency.

The second question is—by which currency should money be kept? It’s not less crucial issue. However, nobody can give exact reply or advice to this question.

In Armenian dram or foreign currency? Any citizen independently decides replying to this question out of which expectations he/she has chosen foreign currency. If the citizen doesn’t trust Armenian dram or considers, that dram may depreciate, then he/she keeps savings in foreign currency.

Moreover, our citizens have bitter experience in this issue. In March 2009 prior to depreciation of the dram the authorities were calling the citizens to keep savings in national currency. Those following the call, naturally, have suffered losses.

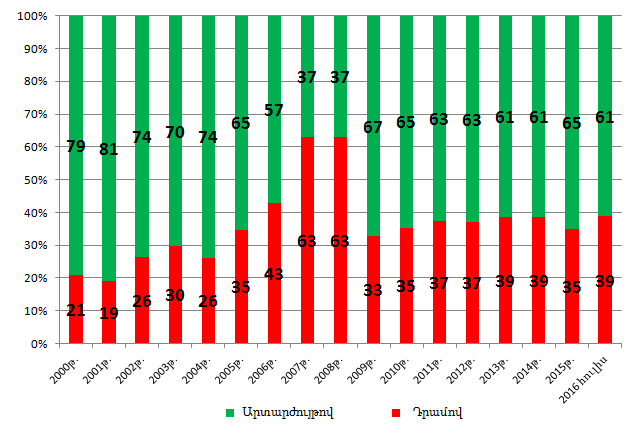

What’s the situation like today? Upon freshest data Armenia’s citizens give preference to foreign currency. As already mentioned, as of late July 2016 from AMD 968.6 billion from AMD 1 trillion 581.8 billion were in US dollar, i.e. 61% of deposit portfolio of the banks is in dollars. In case of term deposits dollarization is higher—64.7%.

However, it’s not always so. In the history of our newly independent state there was a period when deposits in dram prevailed over foreign currency.

Since 2005 specific gravity of deposits in dram started to grow. From 2007 to late 2008 deposits in dram were prevailing with the ratio of 63/37. It was conditioned by constant strengthening of the dram.

In late 2009, as we may see, the snapshot has changed. Specific gravity of deposits in dram changed up to 33%. The main reason was 24% depreciation of the dram in March 2009. As a result, firstly, value of deposits in US dollar grew, and besides that, greater part of people changed the deposits in dram to dollar or simply withdrew from the bank.

The last exchange shock was recorded in December 2014, when exchange rate for one US dollar reached to AMD 460 from 410. The result was reduction of deposits in dram both absolutely and regarding specific gravity.

In late November 2014 deposits in dram comprised AMD 501.4 billion, and 2 months later—in late January 2015—AMD 467.1 billion. And volume of deposits in dollar in that very period reached to AMD 793.7 from AMD 847.1 billion.

This, of course, didn’t bring forward serious changes like in 2009, however, level of dollarization of the deposits was raised by a few percentage points.

By Babken Tunyan