Trust towards Armenian Dram to Weaken

Despite exchange rate of Armenian currency (AMD) was comparatively stable throughout 2015, RA citizens were rather cautious during the year, and preference was given to foreign currency in keeping savings. Data by Central Bank of Armenia, particularly, on level of dollarization, are a proof to that.

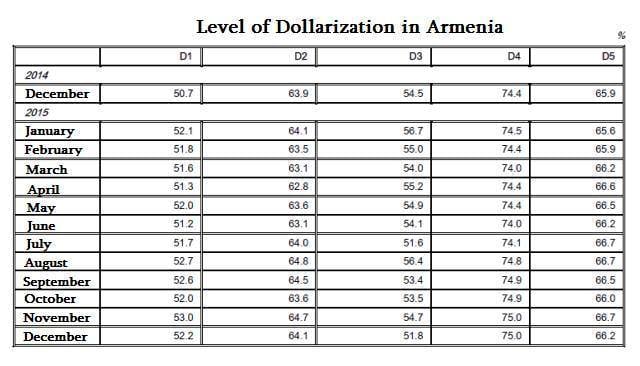

Thus, CBA Bulletin for December covers dollarization level and its variation throughout the year. Central Bank of Armenia counts dollarization level following 5 different approaches, 4 of which are based on deposits, and one—on loans. For instance, D1 indicator shows the ratio of foreign currency deposits of residents and monetary supply. It comprised 52.2% in 2015. Speaking of dollarization, rather frequently D2 is assumed as a basis—unit weight of residents’ foreign currency deposits in their total deposits.

This indicator comprised 64.1% in December, i.e. our citizens keep 64.1% of their belongings in the banks in foreign currency. It’s worth taking into account here that by saying “deposits” both time term deposits and current accounts are considered. According to D2, dollarization level, as compared to the previous month—November, has fallen by 0.6pp, and has increased as compared to the beginning of the current year. Image is the same for D2 indicator. D4 in December remained the same as compared to November—75%, however, it comprised 74.5% in the beginning of the current year. This shows the share of term deposits in foreign currency of resident physical entities in their general term deposits. This indicator will further be touched upon.

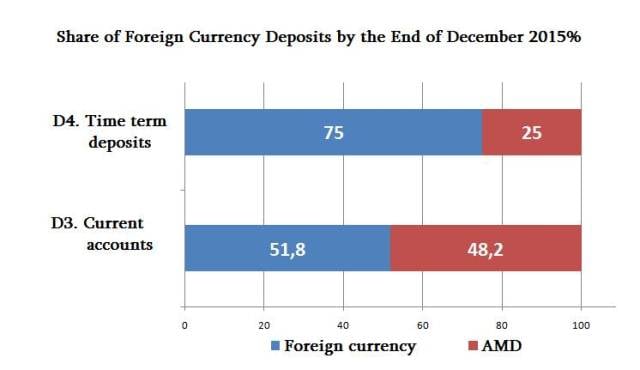

The only indicator, pursuant which dollarization level has fallen in comparison with the beginning of the year, is D3— share of demand deposits in foreign currency of resident physical entities in their total demand deposits. It comprised 56.7% in the beginning of the year, and 51.8% – in December. We realize, that reading, digesting and comparing this information are not among the most pleasant things to do. For this, leaving the aforementioned to the in-depth interested, it’s worth introducing it more clearly. Look at the graphic on D3 and D4 indices of dollarization level.

It’s quite noticeable, that in case of term deposits dollarization level has recorded unprecedented growth.

This means, when a citizen deposits money in a bank, out of cautiousness he/she prefers keeping the belongings in foreign currency, i.e. he/she anticipates that Armenian Dram might be depreciated. In case of demand deposits also more trust is given to foreign currency (51.8 instead of 48.2), however, this is not eye-catching as well, like in case of foreign currency.

The reason is, at any time a citizen may withdraw or change to another currency the demand deposit. That is, in case of depreciation risk he/she thinks he/she would be able to respond. Truly enough, in case of term deposit it’s also possible to withdraw money at any time; accrued interests in this case aren’t calculated though.

Surely, the situation is quite familiar to trade banks. In case of term deposits most of them grant the depositors the opportunity of changing the deposit currency at any time to weaken this spread, i.e. if you have deposited AMD 500 thousand for a year, and have apprehensions that Dram may depreciate, at any time you are entitled to transform your Dram deposit to a dollar one by the day’s exchange rate. However, as CBA data show, this possibility didn’t decrease dollarization of term deposits. As mentioned above, it has risen by 0.5pp throughout last year.

It’s also worth mentioning, that banks in their turn gave preference to foreign currency. 66.2% of credits allocated to the real RA resident sector in late 2015 have been by foreign currency. In the beginning of the year level of “loan dollarization” was lower —65.9%.

By Babken Tunyan