Hard Times for the Banking Sector

Overdue loans of Armenia’s banking system continued to grow in April 2016 and reached a risky index—AMD 46 billion 379 million. Upon RA National Statistical data, as compared to March, volume of overdue loans grew by AMD 892 million or 2%, and as compared to January—by about AMD 6.5 billion or 16.2%.

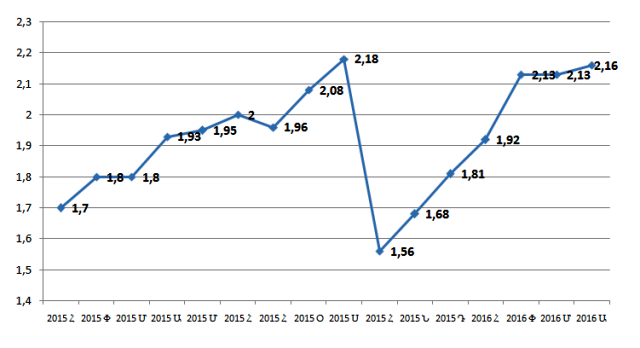

As of late April specific gravity of overdue loans among total loans provided by the banks reached 2.16%. Specific gravity of extended loans of the banks comprises 5.19%. This is a rather high index. Specific gravity of overdue loans was higher only in September 2015—2.18%.

The Chart shows the dynamics of overdue loans of the banking system from January 2015. As we may see, overdue loans recorded stabile growth from the beginning of last year, reaching 2.18% from 1.7%. However, sharp decrease of volume of overdue loans was recorded in October. They have comparatively decreased as compared to September by AMD 12.4 billion or 28%, as a result of which specific gravity reduced to 1.56%.

It’s difficult to say what the sharp fall in October is conditioned by. In any case, the upsetting regularity continued from November, and in the following months overdue loans recorded stabile growth. This growth is a real headache for commercial banks, however, it also edifies of issues of real sector of economy outside the banking system. This means, that legal and physical persons face difficulties regarding obtaining incomes and they aren’t able to serve loans they have taken. Volume of non-performing assets also edify of banking system issues.

According to the report of the Central Bank of Armenia (CBA), as of late April 2016 specific gravity of non-performing assets of commercial banks comprised 9.03% (accounts receivable in non-performing assets, the latter include controllable, non-standard and suspicious assets). As compared to the previous month, specific gravity of non-performing assets recorded an insignificant growth by 0.03 pp, however, as compared to the beginning of the year, their specific gravity has grown by 2.05 pp. All this means that issues of Armenia’s trade banks are deepening, as 2015 was rather unsuccessful for commercial banks. Income indices may be taken for comparison. 6 banks functioned with a loss in 2014, and 7 banks—in 2015. However, volume of losses has increased. In 2014 loss of banks comprised AMD 15.1 billion, and total benefit of banks functioning with profit comprised AMD 36.3 billion. Accordingly, total profit of the banking system in 2014 comprised AMD 21.2 billion.

In 2015 profit and loss seem to change places. Total loss of banks working with loss comprised AMD 37.3 billion, and profit of banks performed with benefit comprised AMD 16.6 billion. Accordingly, the banking system concluded 2015 with AMD 20.7 billion loss. And as of results of the first quarter of ongoing year we have 8 banks functioning with loss, total of which comprises AMD 8 billion. Total benefit of banks comprised AMD 8 billion, and income of the banking system—AMD 0.5 million.

As compared to the previous year, number of branches of banks has reduced as well. By the end of the first quarter of 2015 Armenia’s trade banks had 665 branches, and by the end of the first quarter of 2015 it was 533. Of course, there is growth regarding assets, capital and loan portfolios, however, that growth is rather unevenly distributed and is shared by big banks. This is enough, as reduction of money transfers from abroad, retail trade turnover and import volumes couldn’t but be reflected on indices of the banking system.

However, this is not all. For the majority of banks for the time being there is another crucial issue, which should be settled by the end of the year. They need to reach total normative capital to AMD 30 billion. By the end of the first quarter 7 banks comply with this new demand by CBA. Other banks are in processes to that direction. The other part is in search or didn’t orientate. Artur Javadyan, CBA President, recently stated that besides purchase of ProCredit Bank by Inecobank and BTA by Armeconombank, other merging will be recorded as well.

However, upon information at our disposal, there are 1-2 banks, which not only lack the possibility of increasing capital, but can’t find a partner, with which they can merge. These banks have one way—turn into a credit company.

Note also, that it’s approximately clear which banks will merge and in which case the possibility of tuning into a universal loan organization is great. However, on account of sensitivity of the banking system towards such publications, we’ll abstain from mentioning exact names. In any case, just 6 months are left.

By Babken Tunyan