43% of Registered Taxpayers don’t Actually Function

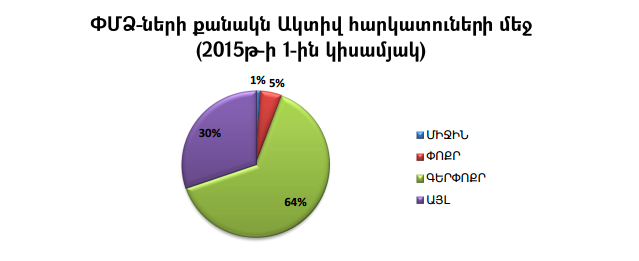

Number of householders registered as taxpayers in state register of 2016 reaches 160 thousand, and according to the information provided by the State Revenue Committee (SRC) 91264 active taxpayers have been registered as of 1 July 2015, 63677 of which comprise the SMEs.

This is stated in comparative report on SME tax field 2013-2015 prepared by the Business Support Team of European Bank for Reconstruction and Development (EBRD).

Authors of the analysis considered active taxpayers those householders (individual entrepreneurs, LLC, CJSC and other trade organizations), which submitted reports for the previous two quarters to tax bodies.

It’s mentioned in the report, that the number of registered taxpayers varies from that of active taxpayers, as in all the cases, when the householder suspends its functioning but submitting an application to the taxation bodies, and stays registered in state register, as a functioning enterprise

“The reason for this distorted snapshot is the fact that the process of liquidation of enterprises is rather difficult and time consuming, as a result of which businessmen in case of closing their business prefer to freeze it by an application of suspension, by that contributing to useless increase in number of non-active taxpayers and distortion of general statistical snapshot,” the report reads.