“Economic growth seems to be an oxygen bag, after having which we may breather freely a bit”

Interview with Arshaluys Margaryan, Head of Public Debt Management Department.

Mr. Margaryan what risks are currently observed in the field of state debt management?

Generally risks of state debt management today, yesterday, and tomorrow, are known to almost everyone and they’re the same. Depending on the structure of debt portfolio, priority of those risks and their management is being regularly changed. Thus, if in your debt the one issued with internal currency has more specific gravity, this means that foreign currency risk reduces, remaining to the extent as much comprises the debt issued in foreign currency.

If the risk of refinancing, i.e. your issued debt has large-volume payments, peaks, then from time to time you consider what may happen if on the day of its payment you won’t be able to issue new debt with that volume. The risk for refinancing is peculiar both to internal and external debt. Ways of its management and tools, depending on debt management skills and market development level, are different. We gradually assimilate those tools in internal and external markets, for instance, release of Eurobonds in 2015, when, parallel to that, we implemented buyback from former release, reducing the risk for refinancing of the previous release, and decreased payment volume to 500 million from 700 million. The next one is the risk of interest rate, which is as powerful as indefiniteness of the interest rate of your debt portfolio.

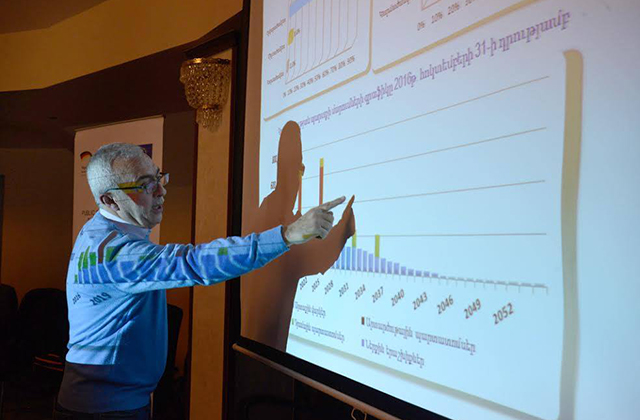

And when does that indefiniteness come out? When you have a big specific gravity of non-fixed interest rate. It may be a debt with indexed, floating interest rate and etc. Probably, one of crucial risky factors for our country, which our debt managers constantly follow and attempt to reduce the so-called current debt risk, i.e. which part of your debt portfolio should be paid in near future. Our USD 5.5 billion debt is extended until 2050. If we suppose that total debt should have been paid in the period of forthcoming 3-4 years, it’s the risk of current debt or management of the timetable of debt payment.

This isn’t the total list of our risks, which is peculiar to the debt portfolio of the countries similar to ours. Regarding other risks the higher the capability of management of your debt is, the more you are able to observe and manage risks beyond this.

The Government has defined restrictions in the next year’s budget regarding involvement of external means, that the debt is manageable and not dangerous. If we take into consideration, that a new debt is needed to pay the debt, won’t it increase the debt burden and make it more risky?

If the state plans the budget with deficit, then it’s that very new debt, that the Government is going to add on the existing debt. There is one circumstance here: the debt is becoming dangerous from the standpoint of service, if it increases more quickly than your economic potential. It’s a universally adopted rule if crisis is observed, the state should implement additional expenditures if the country is at war and should implement military expenditures, taking debt of those countries isn’t explained by any rule, but they take a debt by necessity, to cover the needs.

However, if stabile macroeconomic environment is supposed, and there are prerequisites for economic growth, all those crisis phenomena are eliminated, the state takes debt by certain rules to increase its potential. As a result of the debt taken for capital expenditures, the capability of creating a new value is raising, and taking debt for current expenditures may be compared to the debt taken for celebrating a big birthday. Our Government was rather cautious in those issues. We have never taken money for that birthday. We have taken debt to mitigate the crisis implications and boost economic growth, which may be observed by the dynamic.

However, as a result, today we have economy, which, pursuant the Prime Minister, is in a rather complicated condition, and the public observes that the debt is increasing. How may be productivity of the use of taken debt be measured?

Firstly, productivity assessment should be conditioned by the economic policy of the Government directed to gradual reduction of the influence of external factors. Concerns instigated by the debt will proceed as long as our external sector is considerably dependent on Russian market. However, I observe that our dynamics isn’t so, our external ties are rather diversified. The more they’ll be diversified, the more dependency on Russian market regarding both import and export, will reduce.

Secondly, in case of correct use of our internal resource, our export potential and speedy GDP growth concerns over the debt will be mitigated. They generate when people see, that the debt is growing for a long period, however, economy doesn’t develop by that temp. Our debt from the day of establishment of our state hasn’t reduced any year, it has constantly grown. However, until 2000 the debt was growing more quickly than the GDP, in the period of 2000-2008 the debt was growing, however, specific gravity in GDP was decreasing and in 2008 it reached 14%, then as a result of crisis, we again began taking debt and it reached more than 50%, like in 1999, i.e. we reached approximately the same level.

For the following year we planned smaller deficit, and the debt’s specific gravity will decrease again. There is no other variant, as economic growth for us is like an oxygen bag, after having which we’ll breathe freely, and everybody will again forget about the debt, like they have forgotten during this year. Formerly the debt was being touched upon for the reason that the information was private, and when we opened it, they stopped talking about it.

Currently it’s again being touched upon, as it’s visible for them—the debt is growing, and consuming demand is decreasing, and economy isn’t developing. It depends on us, however, more on the outer world. We need to work in two directions: unroot factors depending on us, weaken dependency on the external side, for which it’s simply necessary to have many friends.

Casting a retrospective glance, how justified is payment of Russian debt through Eurobonds?

Firstly, debt managers look forward and not backwards, however, the issue here is the following—we had interest rate risk linked to the specific gravity by floating interest rate. The smaller it is, the lower is the risk for our interest rate. Another argument is undeniable as well, in financial markets, except the tools that everybody sees and may assess, the market of derivatives is available as well, i.e. many tools, by which trade is being operated, as a result of which price for everything is being defined. Russian debt was the one with floating interest rate, which is being exchanged with fixed debt by deals of millions of dollars.

At the moment of our deal fixed interest rate comprised 6.25%, swap interest rate of Russian debt—5.87%, i.e. the difference was less than 0.5%. However, in the period of recent one month growth of that 5.87% was more than 1%. Pursuant the assessments of all specialists, both internal and external, it was a perfect deal. If we take political contexts of assessments, no one casted doubt on professionalism of that deal.

By Gayane Khachatryan