What will follow 6.5% growth?

First data of 2017 are already known: National Statistical Service of Armenia issued initial macroeconomic indices for January 2017.

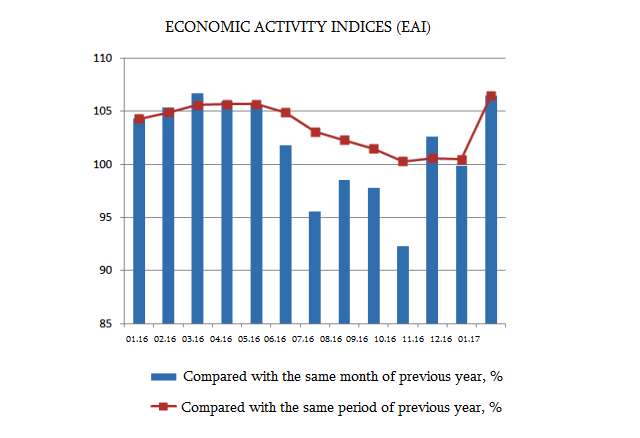

The most important perhaps is economic activity index (EAI). According to the National Statistical Service EAI comprised 106.5 compared with the same period of 2015 (i.e. EAI has grown by 6.5%).

True, the year has just started, and it isn’t so proper making judgments for a month, however, 6.5% isn’t a bad index, if we take into consideration that in January 2016 basis for comparison is rather high.

It should be noted that the beginning of 2016 was promising: in January 2016 compared with January 2015 EAI was 4.3%, in February it reached 5.4%, in March 6.7%. After that growth temp started to weaken and in June, compared with the previous year, it dropped up to 1.8%.

In the second half of the year, indices became decadent. The deepest decline was recorded in October 2016—7.7% decline compared with October 2015. Only in November 2.6% growth was recorded, however, December was decadent as well.

As a result, growing index of economic activity worsened. If in the first semester (January-June 2016) we have 4.9% EAI, upon year’s result (January-December) growth temp reduced up to 0.5%.

Real growth temp of GDP for 2016 hasn’t been issued yet, however, it isn’t difficult to suppose, that it’ll be within 0.5%, i.e. lower than the anticipated index.

According to state budget 3.2% economic growth is anticipated for 2017. Will that index of growth be provided? 6.5% for January isn’t a bad start, however, the example of the very previous year, that optimistic judgments can’t be made based on it.

Factors negatively impacting over Armenia’s economy don’t have the tendency to weaken in visible future. In particular, Russia’s economic growth in 2017, upon anticipations will be 1% in average, i.e. considerable growth of money transfer flows can’t be anticipated.

Regarding internal atmosphere, the state has adopted a restraining fiscal policy for 2017. Compared with 2016 state consumptions will considerably reduce, which will have a negative impact on economic growth.

Besides that, in April we have parliamentary elections, and in May elections for the Council of Elders are scheduled. And electoral processes bring forward certain expectant moods and uncertainty and also have an effect on economic activity to some extent in a negative sense.

On the other hand, however, Central Bank of Armenia (CBA) continues weakening conditions for fiscal policy. On February 14, 2017 CBA Council decided to reduce refinancing interest rate by 0.25 percentage points, defining it 6.0%. This is a rather low rate: last time refinancing rate was defined 6% 6 years ago—in February 2010.

On the whole, from early 2016 until now refinancing rate decreased by 2.75 percentage points. To some extent this can activate economy through active loaning, however, as previously stated, refinancing rate is a fiscal tool meant for regulating price growth, and one shouldn’t rely on it only to provide economic growth.

The only resource to provide growth is investments. The government promises to provide foreign investments amounting a few million dollars in 2017. Last week online platform for foreign investments has been launched by the Ministry of Economic Development and Investments of Armenia, through which a few dozens of ready investment projects in various fields are introduced. However, it’s impossible to speak of investment flow now.

Coming to indices for January, it should be stated that compared with January 2016 growth was recorded in all economy fields, except construction.

Thus, volume of industrial production grew by 12.2% and comprised AMD 108.1 billion. Almost with the same volume—12.1%, the field of service recorded growth, and the volume is AMD 96.2 billion. Temp of agriculture growth is low—0.2%, production volume in the field of agriculture in January comprised AMD 16 billion. And constriction has reduced by 5.3%: construction amounting AMD 7.6 billion has been implemented in January.

Volume of internal trade turnover in January comprised AMD 128.8 billion, which exceeds by 9.4% the index of 2016 for the same month.

External trade turnover recorded sharp growth. In January 2017 external trade volume of Armenia comprised USD 358.7 million, which is more by 45.5% from the index of January 2016, from which: export has grown by 35.4% and comprised USD 121.5 million. And the temp of import growth is higher—51.4%. This January commodities amounting USD 237.2 million have been imported to the Republic.

By Babken Tunyan