On implemented and promised investments

Foreign investments have become one of the most contemporary promises of this election campaign. Almost all promise investments, some—many, some—few, some give exact numbers and some—not.

We may say foundation for investment “trend” was laid by RPA represented by the new Government. One of the first steps of PM Karen Karapetyan, as we remember, was renaming the Ministry of Economy to Ministry of Economic Developments and Investments. The new Government has initially put the stress on investments, as there was no other way out. It’s impossible to simultaneously implement optimization, pass on to reduction of budget expenditures, and provide economic growth on account of internal resources.

It should be noted that the Government promised USD 3.2 billion foreign investment throughout 5 years, from which: USD 840 million should be implemented this year. The directions have been mentioned regarding this year’s investments, and in cases of some programs—sources for funding as well.

Days ago Investors’ Club was launched, which is one of the active trumps of RPA and the incumbent government. Mostly Armenian businessmen, representing Russian capital, promised to make investments in Armenia.

Other powers participating in elections also stress investments, however, without specificity: the main point is that in case of coming to power, rule of law and healthy competitive environment will be established, which naturally, will contribute to investment flow. Opposition powers were much covering investments in another context—they were expressing doubt on figures promised by the Government. And meanwhile some powers were considering promise of USD 3.2 billion investments unrealistic, another impressive figure was mentioned—USD 15 billion. This figure was mentioned by “Tsarukyan” alliance leader Gagik Tsarukyan.

Investment of USD 3.2 billion is a big number for Armenia’s economy. However, USD 15 billion is immense.

Let’s introduce a few data on investments to have a clear view on what is meant.

In the period of 1992-2016 in the whole period of newly independent Armenia’s history, net inflow of foreign investments in Armenia’s economy didn’t exceed USD 7 billion (based on data provided by the World Bank).

Another data, this time from National Statistical Service of Armenia: from 1988 to late September of 2016 total of foreign investments in Armenia comprised AMD 5.9 trillion (by today’s exchange rate around USD 12.4 billion). From which: flow of direct investments comprises AMD 3.4 trillion.

As for pure reserves of foreign investments in the same period that index regarding general foreign investment comprised around AMD 2.5 trillion.

In short, Gagik Tsarukyan promises to bring more foreign investments to Armenia, than our country had throughout the history of its existence.

He didn’t clarify where from those investments will come. He only said, “By God’s will, when time for victory comes, they’ll come with their planes, will introduce themselves. Of course, the representative of all that is Mr. Tsarukyan with his behavior, his respect.”

It isn’t clear either in which period those investments will be implemented—in the same year or step by step? Of course, in one year entry of such amount is rather unbelievable (our economy can’t digest that much either). That’s why let’s suppose that he means in the forthcoming 5 years. It turns out every year USD 3 billion foreign investments will be implemented in Armenia’s economy.

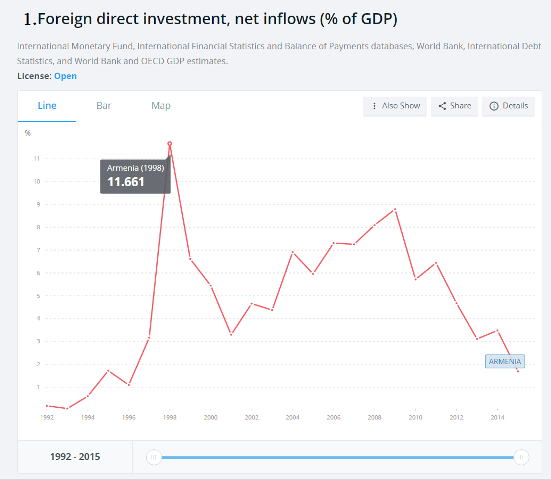

USD 3 billion comprises 30% of GDP, i.e. it’s promised to provide investments comprising 30% of GDP. Is that a big index? To have a clear snapshot we’d better look at the Chart provided by the World Bank (N1). Net inflow/GDP ratio of direct foreign investments for 1992-2015 is introduced in the Chart. The highest index was recorded in 1998—11.7%. Especially in the period of recent years, as you may see, that index is rather low. In 2015 that ratio comprised 1.7%.

It should be stated that based on 2015 data that index in the world is 2.8%, in Europe and Central Asia (in which Armenia is involved)—3.6%, in small countries (in which Armenia is found as well)—4.3%.

From our neighbors net inflow/GDP ratio of foreign direct investments in Georgia comprised 11.2% in 2015, and 7.6% in Azerbaijan. Abnormal index—54-5% was recorded only in Azerbaijan in 2003-2004, which was conditioned by implemented large investments in the field of oil extraction.

Having in mind these figures one may understand what net inflow/GDP 30% ratio of direct foreign investments means.

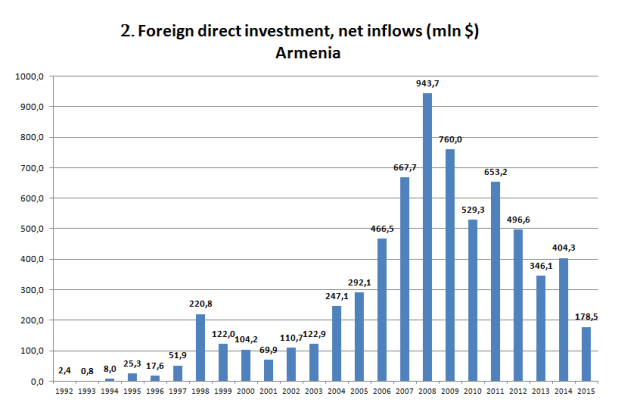

Chart 2 may be observed as well, where net inflow of direct investments made in Armenia is introduced. As we may see, maximum index was recorded in 2009—USD 943.7 million. And, e.g. in 2015 that index comprised USD 178.5 million only (it was less in 2016).

Figures and charts were introduced so that the reader had a better view of seriousness of promised figures. We don’t give assessments: are promises realistic or not? We simply provide the opportunity to compare the mentioned figures with actual results and draw conclusions independently.

By Babken Tunyan