How will new Tax Code influence on a citizen’s pocket?

The amended version of the Tax Code, which was introduced into the agenda of NA extraordinary session by the second reading, rather late appeared on NA official website. The MPs and experts basically had no time to familiarize with the amendments after the first reading and mainly had to be led by the speech and answers of RA SRC Deputy Chairman Vakhtang Mirumyan.

In any case, changes in some essential issues have been implemented. As it’s impossible to reflect to all issues, it’s worth clarifying only the part of income tax.

The amended version of the Tax Code offers the following rates and thresholds for the income tax:

Up to AMD 150 thousand—23%, from AMD 50 001 to AMD 2 million—AMD 34 500 plus 28% exceeding the amount of AMD 50 000, more than AMD 2 000 001—AMD 552 500 plus 36% of the amount exceeding AMD 2 million.

The following rates were proposed upon the first reading of the Tax Code:

Up to AMD 120 000—23%, from AMD 120 001 to AMD 1 000 000—AMD 27 600 plus 28% of the amount exceeding AMD 120 000, more than AMD 1 000 000—AMD 274 000 plus 33% of the amount exceeding AMD 1 000 000.

And upon current legislation the following mechanism is functioning:

Up to AMD 120 000—24.4%, from AMD 120 001 to AMD 2 000 000—AMD 518 080 plus 36% of the amount exceeding AMD 2 000 000.

As we may see, 3 main changes have been implemented:

1.Minimum threshold has risen from AMD 120 thousand to AMD 150 thousand,

2. The second threshold has risen from AMD 1 million to AMD 2 million,

3. In case of salary more than AMD 2 million the rate has changed from 33% to 36%.

What does this mean? Who will gain from this and to which extent?

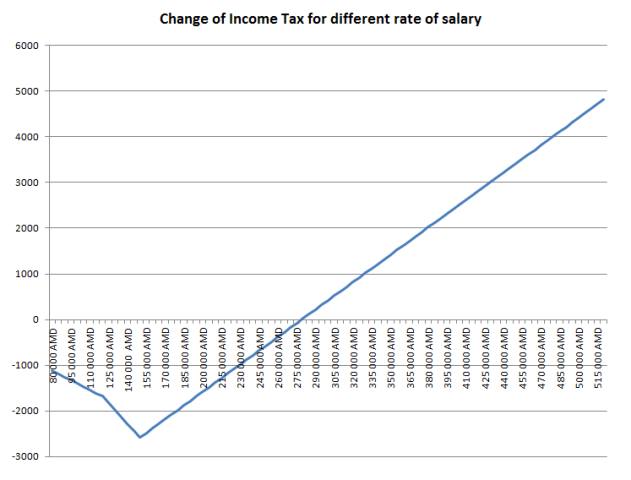

V.Mirumyan has already stated that productive reduction of rates is planned: in case of salaries up to AMD 280 thousand, income tax saving will be noted. Thus, they’ll pay less.

Of course, he is right, however, it’s worth clarifying.

Up to AMD 279 thousand (inclusive) burden of income tax will ease in different dimensions.

Income tax in case of AMD 150 thousand will ease—instead of AMD 37080 they’ll pay AMD 34500, less by AMD 2580.

Then that “benefit” reduces and the difference of income tax on salaries comprising AMD 279 thousand nullifies: upon acting legislation AMD 70620 income tax is paid from salaries comprising AMD 279 thousand, and pursuant current draft Tax Code income tax for the salaries comprising AMD 279 thousand is the same—AMD 70620.

Burden of income tax grows from AMD 280 thousand. For instance, in case of AMD 500 thousand salaries income tax will be more by AMD 4420—AMD 132500 instead of AMD 128080.

To be simpler, the state has put the emphasis on low and average salaries. Pursuant the Tax Code, adopted by the first reading, only those receiving salaries AMD 204 thousand were gaining from this, and currently—AMD 280 thousand, i.e. the number of people content with the Tax Code has grown and reached 550 thousand, which according to Vakhtang Mirumyan, comprises about 90% of employees.

How about the others? It refers to those with higher than average salaries (firstly employees in the field of IT and financial sector). The state proposes a compromising variant to them—making the second threshold AMD 2 million from AMD 1 million.

What does this mean? Those receiving higher salaries will pay more income tax, than they used to, however, less than anticipated by the variant adopted by the first reading.

For instance, the one with AMD 1 million 200 thousand salary today pays income tax amounting AMD 310080. Upon currently discussed draft Tax Code they will pay more—AMD 328500. However, upon the variant adopted by the first reading they should pay even more—AMD 340000.

In short, tax burden of high and super high salaries increases, however, not as much as by the former version. It’s another question whether it’ll be sufficient for employees in that group or not.

By Babken Tunyan