Siemens to buy U.S. software maker mentor for USD 4.5 bln

Siemens AG agreed to buy Mentor Graphics Corp. for $4.5 billion in its biggest acquisition since 2014 as the German engineering company extends its industrial software capability, Bloomberg reports.

Siemens will pay $37.25 a share in cash for Wilsonville, Oregon-based Mentor, the industrial giant said in a statement on Monday. That’s 21 percent above the closing price on Friday. Elliott Management Corp., which owns 8.1 percent of Mentor’s shares, backs the offer, Siemens said.

The deal follows Siemens’s $970 million January purchase of U.S. computer-program maker CD-adapco of the U.S. as Chief Executive Officer Joe Kaeser seeks to grow the digital business as part of a retreat from consumer-oriented products to focus on industrial applications. Mentor is the biggest acquisition announced by the Munich-based company since it agreed to buy Dresser-Rand Group Inc. for $7.6 billion. For its part, Mentor was under pressure to increase shareholder value from activist investor Elliott, which doubled its stake in September.

“The footprint of Mentor Graphics will allow us to reach a lot more customers,” Siemens software executive Chuck Grindstaff said on a conference call. “This offers a unique opportunity to design products in a more holistic way.”

Savings Forecast

The asset is a perfect fit and will set the pace in the industry, Siemens Chief Financial Officer Ralf Thomas said on the call, adding that there will be some job cuts resulting from the combination. Cost savings of more than 100 million euros ($108 million) per year are expected by the fourth year of ownership, Thomas said.

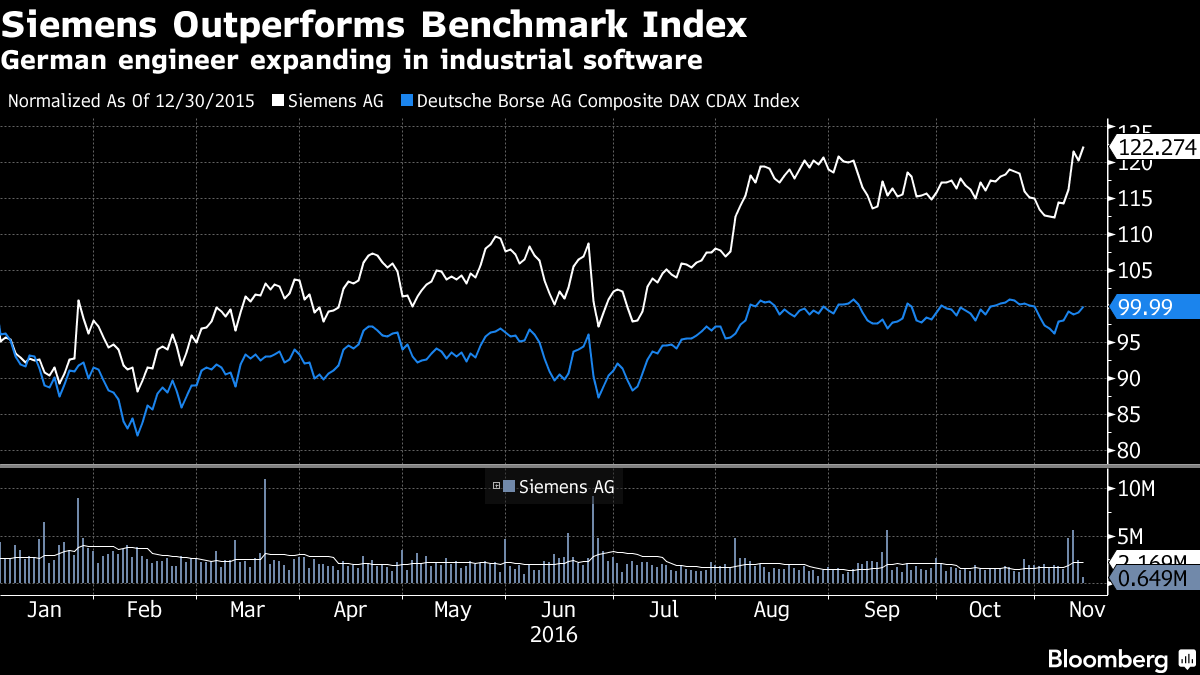

Mentor shares surged 19 percent to $36.47 in trading before U.S. exchanges opened. Siemens rose 0.9 percent to 109.15 euros as of 2:12 p.m. in Frankfurt, extending the year’s gain to 21 percent.

The agreed price isn’t overly expensive and will make Siemens more competitive in the industrial software business, German brokerage Baader Helvea said in a note to clients. The value of the transaction includes net debt.

The purchase is expected to boost Siemens’s earnings before interest and taxes by more than 100 million euros within four years of closing and will contribute to earnings per share within three years, the company said. Siemens’s digital factory unit, which will house Mentor after the deal closes, contributed 10.2 billion euros to Siemens’ 79.6 billion euros of revenue in the financial year through September, according to data compiled by Bloomberg.

Mentor sells software and hardware used to design electronics for the semiconductor, automotive and transportation industries. The company reported a loss of $10 million in the six months ended July 31, compared with profit of $21 million in the same period last year, according to an Aug. 18 regulatory filing. The company forecast revenue of $1.22 billion for the 12 months through January.

Under Kaeser, Siemens has pushed deeper into software applications that are crucial to run its industrial equipment. At the same time, Siemens is simplifying its sprawling portfolio, and the company announced last week that it wants to list its health-care subsidiary, among the biggest makers in the world of diagnostics and imaging equipment.

Elliott, run by billionaire Paul Singer, said when it raised its stake it saw numerous opportunities to boost Mentor’s “deeply undervalued” shares and had started talks with the company’s management and board. The acquisition is a “great outcome” for Mentor shareholders as the company will benefit from Siemens’s increased scale and greater resources, portfolio manager Jesse Cohn said in e-mailed comments.

The agreement comes almost six years after activist investor Carl Icahn unsuccessfully pushed for a sale of Mentor. He bid $17 a share in February 2011 for Mentor in an attempt to lure other suitors for the software maker. Icahn, who was Mentor’s largest shareholder at the time of his bid, sold a chunk of his holding back to the company at $18.12 a share in February of this year, and he sold his remaining stock in May.