Russia has exited recession in two decades

Russia has exited recession, with a little help from the boys in uniform, a major statistical revision – and the global oil price. And not just any recession, but its longest in two decades. So what happened?

1. Is the economy really out of the woods?

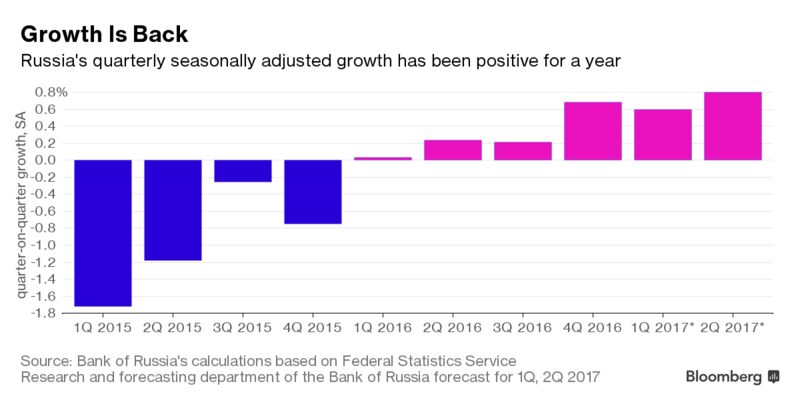

Actually, the contraction ended a few quarters earlier than previously estimated, according to revised calculations by the Bank of Russia’s research and forecasting department. The Federal Statistics Office hasn’t released a quarterly growth figure since 2015, so that’s not an official, official number. The central bank had thought that quarterly growth turned positive only in the second half of last year. Now it seems Russia has been in the black since the first quarter of 2016.

Part of the reason for that is a reclassification of military spending. Double-digit percentage increases in spending on weapons systems now feed directly into better output data, which hadn’t been the case before. And it just so happens that President Vladimir Putin is in the midst of the biggest boost to the armed forces since the Cold War.

“The first monthly data of this year showed more signs that Russia is expected to enjoy a broad macro recovery in 2017,” Dmitry Polevoy, economist for Russia at ING Groep NV in Moscow, said in a report. “A significant improvement of activity in January probably related to the stronger ruble, lower inflation and improving domestic demand.”

2. So the recovery is not just down to the oil price?

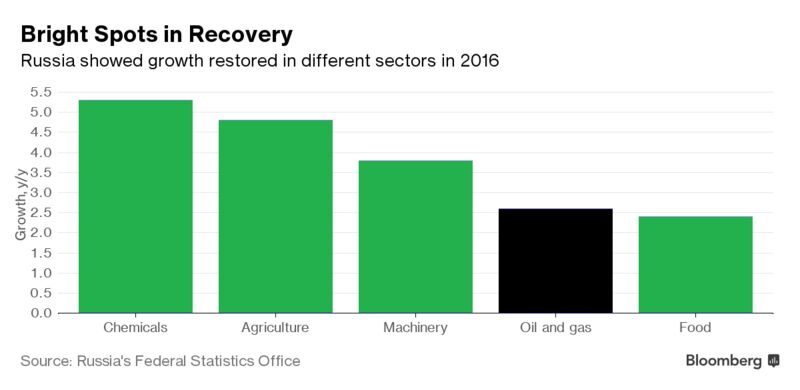

Well, it is a bit. Oil prices are rising following the OPEC agreement on output cuts last year. Russia overtook Saudi Arabia as the word’s largest crude producer in December as both nations started adhering to the agreed cuts. Russia’s Urals export blend averaged $53.32 in the first two months of the year, while the government plans on the basis of oil at $40 this year. Oil and gas contributed 40 percent of Russia’s budget revenue in 2016. But, other sectors are growing too.

“In 2016, growth in non-energy sectors was a nice surprise,” Vladimir Miklashevsky, senior strategist at Danske Bank A/S in Helsinki, said. “For changes in the structure of the economy, growth in non-energy sectors is more important for better long-term prospects than the increase in oil prices and production.”

3. Aren’t sanctions hurting?

Russian officials have been saying, in unison, that the country has become used to sanctions and can carry on just fine. In response to Russia’s annexation of Crimea and support for separatists in eastern Ukraine, the U.S. and the European Union imposed curbs including limiting access to western capital and technologies.

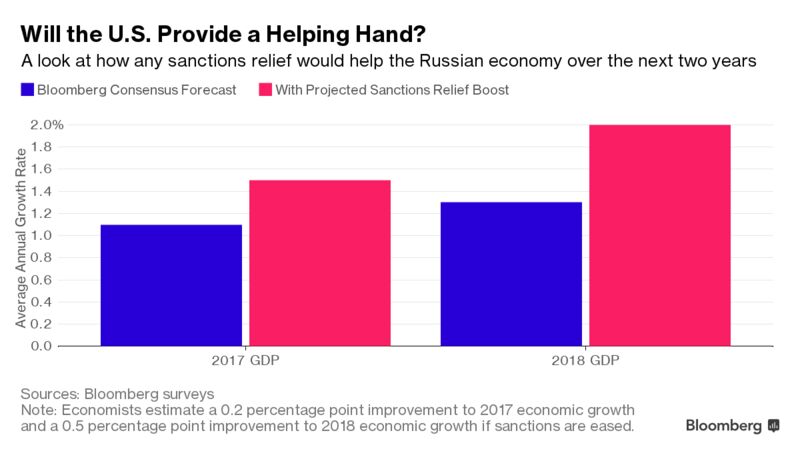

The economy would undoubtedly get a lift if the Trump administration – currently embattled because of alleged links to Russia – decides to ease the restrictions the government has already imposed. According to the majority of economists surveyed by Bloomberg, the ruble would gain 5 percent to 10 percent in value in such a case.

GDP would also get a boost, to the tune of 0.2 percentage point this year and 0.5 percentage point next year, the survey showed. The International Monetary Fund has calculated that the international restrictions might have initially reduced real GDP by 1 percent to 1.5 percent, while prolonged curbs may result in a cumulative loss of as much as 9 percent of economic output in the medium term, according a staff report in 2015.

4. What about ordinary Russians, how are they doing?

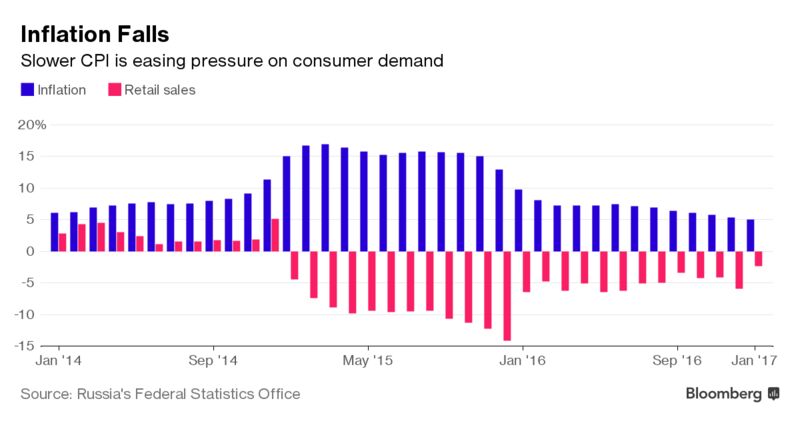

Consumer demand was the main growth driver in Russia for decades and it bore the brunt of the recession as inflation, propelled by the ruble’s fall, choked it. Inflation is easing though, thanks to tighter policy from the central bank with its inflation goal in mind. While retail sales are yet to catch up and move into positive territory, they have curbed their decline, the Federal Statistics Service said Feb 22. The Bank of Russia is targeting 4 percent inflation by the end of 2017, while economists in a Bloomberg survey see consumer-price growth easing to 4.3 percent by then.

5. How do the growth forecasts compare with the past?

Well, they’re not spectacular. Part of the reason is that, according to central bank governor Elvira Nabiullina, the country needs reform to unlock further possibilities. Without that, growth potential will likely be capped at 1.5-2 percent. That mightn’t be enough to satisfy Putin. He’s told Economy Minister Maxim Oreshkin to prepare a plan to accelerate growth to match that of the global economy by 2019 – – a prospect that would mean they’ll have to find at least another percentage point from somewhere.